This Review Covers:

- Overview

- What Do Users Like About Wave?

- What Don’t Users Like About Wave?

- What Pricing Plans Does Wave Offer?

- What are the Standout Features of Wave?

- Positive User Highlights

- Negative User Highlights

- What are Wave’s Ratings from Other Review Sites?

- What’s My Final Verdict on Wave?

Overview

Let’s talk about Wave, a cloud-based payroll and accounting software that caters specifically to small businesses. I appreciate that it has a lot to offer, including automatic payroll calculations, direct deposit, tax form preparation and filing, and employee self-service portals, to name just a few — and the best part is that it’s all free for up to 10 users.

But beyond that, there’s more that I find useful about Wave – it also provides invoicing, receipt management, accounting, reporting, and banking features that integrate seamlessly with a suite of accounting and financial tools. So with these features, I feel Wave offers businesses a comprehensive financial management solution that goes beyond just payroll.

However, I promised an honest Wave review, so I must also talk about its downsides. While the software sticks true to its target audience of small businesses, I feel it misses out on some features that would be appreciated by a business of any size, such as time and attendance tracking perhaps. And while email customer support is always there, the lack of phone support makes me feel a bit meh. But my biggest concern is the fact that Wave does not support all state tax forms, which makes me question the software’s usability for companies with employees in multiple states.

But before we make any judgements in this Wave review, let’s first take a look at what else the software has to offer.

What Do Users Like About Wave?

- Free to use for invoicing and accounting

- Cloud-based

- Invoice generation

- Receipt tracking

What Don’t Users Like About Wave?

- Lack of customizations

- No live bank feeds

- Customer service is limited to email

- App crashes

- Tax filing not available in all states

What Pricing Plans Does Wave Offer?

Wave offers six pricing plans for its services, namely:

Invoicing: This free plan allows users to create customized and professional-looking invoices, send automated reminders, and enable credit card, bank, and Apple Pay payments directly from invoices.

Accounting: This free plan allows users to track income and expenses, add unlimited partners, collaborators, and accountants, make unlimited bank and credit card connections, and use helpful reports such as overdue invoices and bills.

Payment: This pay-per-use plan costs 2.9% plus $0.60 per transaction or 3.4% plus $0.60 per AMEX transaction for credit cards, or 1% plus $1 minimum fee for banks. It allows users to give their clients the flexibility of paying through bank deposit, credit card, and Apple Pay, get money in as fast as 1-2 business days, and set up recurring billing and payments for retainer clients.

Payroll: This monthly plan allows users to pay employees and contractors with ease, deposit payments into employee’s bank accounts with just a click, and give employees access to paystubs and tax forms. In Tax Service States, Wave provides tax services such as handling all payroll tax filings and payments on the user’s behalf at a base fee of $40 per month and $6 per active employee and $6 per independent contractor paid. In Self-Service States, it does not include tax services and comes a base fee of $20 per month and $6 per active employee and $6 per independent contractor paid. Both variants include features such as direct deposit, unlimited pay runs, automatic payroll tax calculations and payments, year-end tax form preparation, employee self-service, and more.

Mobile Receipts: This monthly or yearly plan allows users to access expense information digitally in one place, making tax prep painless with accurate books and reports. Users can also enjoy unlimited receipt scanning and import up to 10 receipts at a time. This plan costs $8 when billed monthly, or $72 when billed annually.

Advisors: This plan allows users to access expert support anytime. Bookkeeping Support costs $149 per month, while Accounting and Payroll Coaching costs a one-time $379 fee, with other packages also available.

What are the Standout Features of Wave?

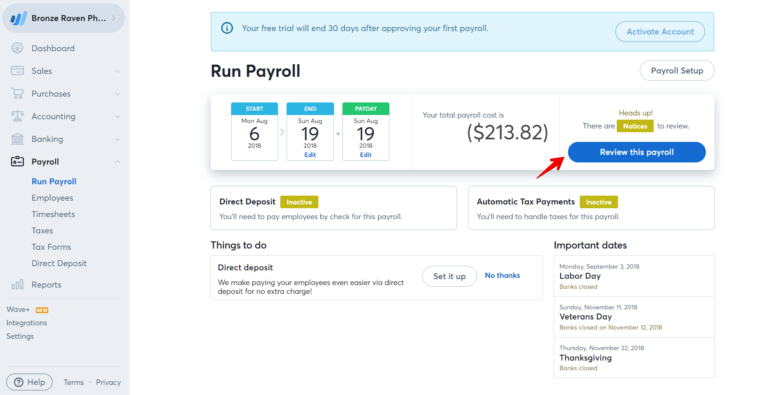

1. Automated Payroll

Wave’s payroll feature includes automated payroll processing and W2/1099 form generation for contractors. The software automatically pays and files state and federal payroll taxes and makes direct deposits to employees’ bank accounts. Wave also offers worker’s compensation which simplifies annual employee audits.

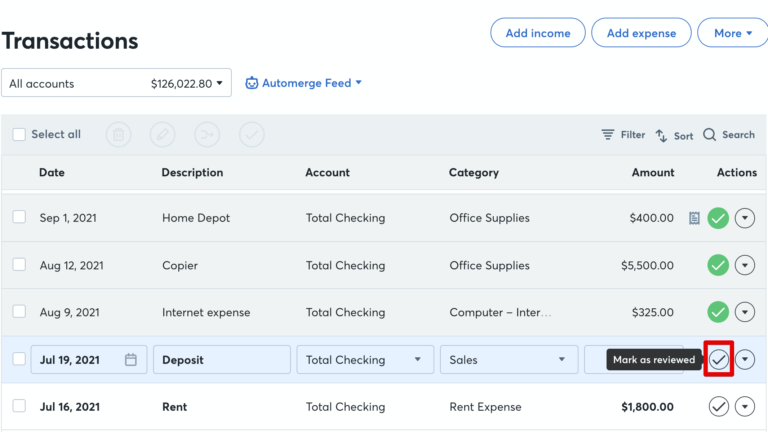

2. Double-Entry Accounting

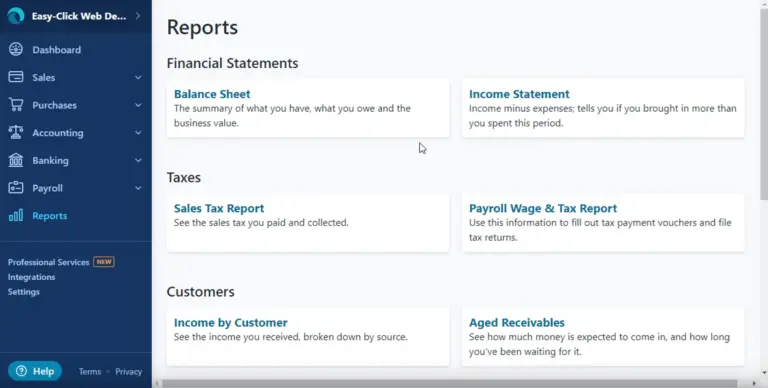

Wave’s double-entry accounting feature records each financial transaction in two accounts, ensuring that the total debits equal the total credits. The platform automatically creates a general ledger account for each transaction, allowing businesses to track expenses, revenue, assets, and liabilities. One of the key benefits of Wave’s double-entry accounting feature is that it makes it easy for businesses to generate financial statements and reports, such as balance sheets, income statements, and cash flow statements.

3. Receipt Management

Wave’s receipt management feature allows small business owners to keep track of their expenses by scanning and uploading receipts directly into the software. Receipt images can be uploaded to the transaction details of an expense, storing proof and supporting documents in case of audits. These images are then uploaded to cloud and can be easily accessed from any device.

4. Basic financial reporting and analysis

This Wave review won’t be complete without discussing its financial reporting and analytic features. Wave offers basic financial reporting functionalities that simplify the generation of critical financial reports. These reports comprise a payroll summary report that summarizes all payroll-related activities and associated costs, such as gross pay, taxes, and deductions. Additionally, the software generates a tax liability report that calculates the total tax liability owed by the business and breaks it down by tax type. Other financial reports available on Wave include a pay stub report that illustrates each employee’s pay stub details and an expense report that tracks employee expenses.

Selected Positive User Feedback:

- “Wave is super easy to use, quite intuitive and does everything I need for my small business.”- Andy N. (Source G2)

- “I can create invoices from my phone and send them to the client. Just a couple of clicks, and I am done.”-Natima H. (Source G2)

- “I like that it is easy to use WAVE. I can take a look at my business bank accounts in one place. It’s nice to have the option to send invoices outside of my CRM.” – Shawniece E. (Source G2)

- “Very user-friendly, has great help guides, and a vibrant community that collaborates and helps others.”– Reggia A. (Source G2)

- “Bank integration works seamlessly. Super easy to tag transactions and close accounting and conciliation of accounts.” -Martin C. (Source G2)

- “It’s free to use and do all your accounting. It is easy to get your reports to do taxes or just look at your P & L’s. It works great and is quite easy. You can do payroll with it but you do have to pay for that, so if you are a tiny business it works great as you don’t need payroll. You can also take online ACH and Credit Card payments.” – Josh C. (Source G2)

- “Wave has features that were lacking in other comparable programs. I use the invoice function quite a bit as I bill clients for hourly work. It automatically numbers invoices sequentially, keeps track of paid and unpaid invoices and has an easy set up to accept credit cards and bank payments, a feature lacking in many other basic business programs. ”-Marc W. (Source G2)

- “A minimal learning curve also has a mobile app. It also allows you to send recurring invoices with several reminders” – Amar A. (Source G2)

- “I love that Wave is free to use & easy to use.” – Brandon T. (Source G2)

- “You can take ACH and CC payments if you want and turn them off on invoices you don’t want it on. ”- Josh C. (Source Capterra)

- “The integration with our system at the time was wonderful and streamlined our workflow.”- Jessica M. (Source Capterra)

- “It has a dashboard that allows you to see charts for overdue invoices, bank accounts and credit cards.” – Verified User (SourceCapterra)

- “User-facing pages are nice looking, invoices and other docs look professional.” – Lawrence D. (Source Capterra)

- “I have been using this for payroll and bookkeeping for the last several years. It is super easy to use and has almost all the features I need. I create T4s on it and can invoice clients!.”- Holly P. (Source Capterra)

- “I love the ease of setting up, having payroll calculated & making payments.”- Rebecca S. (Source Capterra)

Selected Negative User Feedback:

- “It takes several days to initiate patrol so it would be nice if we could submit payroll based on future invoices because sometimes cash flows are not synonymous with payroll issue dates.”- Kojenwa M. (Source G2)

- “Sometimes I feel that it gets hard to get a refund. It could be more specific.”-Verified User in Accounting and Marketing. (Source Capterra)

- “My biggest problem was customer support, very limited and useless. There is a hidden fee that is not mentioned which should be disclosed. A bit of a trust issue with this system.” Verified User (Source G2)

- “Customer service is mainly by chatting with a bot. They have no help pages. The bot is generally useless and we have to eventually email for support. They have no phone support at all.” – Lawrence D. (Source G2)

- “Missing overseas / foreign payroll business rules and setup and unable to customise.” – Maheen Z. (Source Capterra)

- “Some solutions require a work-around that is not intuitive.” – Geoff J.(Source Capterra)

- “The mobile interface does not work very well. The app sometimes crashes. Other than that, there are no other cons with the software.” -Jenniffer N. (Source G2)

- “Bit of a useless system when it can’t complete all of Canada’s payroll. QC not accepted. Lack of customisation options.”- Barbara H. (Source Capterra)

- “Sometimes things change, etc. and running an “emergency” extra payroll is difficult and time-consuming.”- Matt G.(Source Capterra)

- “Sometimes it is difficult to extract the exact info I am looking for. I also get double transactions in the transaction list for certain payments. No live bank feeds.” – Verified User in Education Management (Source G2)

- “The connection between bills, payroll, and contractor payouts is not super intuitive, and I have to slow down and walk through the steps each week to be sure I have completed the flow correctly.”-Alyssa C. (Source Capterra)

- “One thing where they should improve their work is a mobile app. It has some bugs also often crashed while using this.” – Mohit S. (Source G2)

- “Wave payroll takes some time to credit your payment to your bank account. I always received a message that I received amount however in my bank account it appears after 3-4 days.”- Netram M. (Source G2)

- “I dislike the lack of reports that I can generate, for example, departmental allocation. Possibly the features are there, but I have yet to stumble upon them.”- Kingsley S. (Source G2)

- “Only problem is it takes a few days before the money is in the account.”- Earl H. (Source G2)

What are Wave’s Ratings from Other Review Sites?

(As of January 2024)

- Capterra: 4.4/5

- G2: 4.4/5

- GetApp: 4.4/5

- Google Play: 3.6/5

- App Store: 4.5/5

What’s My Final Verdict on Wave?

Wave is a cloud-based payroll solution that caters to small businesses. With features like automatic payroll calculations, direct deposit, tax form preparation, tax filing, and employee self-service portals, Wave is quite a comprehensive software.

There are many positive things about the software that we’ve gone over in this wave review, but what I like most is that it’s cost-effective. I appreciate that businesses on a budget can use its free plans, which includes accounting, invoicing, and banking features. Wave also offers a user-friendly interface that integrates with a comprehensive suite of accounting tools and offers detailed reporting features.

Because I Promised an Honest Wave review, I must also discuss where it falls short. In my opinion, although the software has an impressive set of features, it is not sufficient for larger companies with more complex payroll requirements, which is fair given that they’ve specifically targeted smaller businesses. But I guess that’s something larger organizations should be very clear on. Moreover, I find that the absence of phone support is very inconvenient when businesses have urgent payroll issues that need immediate assistance. Its Android app isn’t that great either, with a low rating of 3.8/5 stars on the Google Play Store. Additionally, if your business operates in multiple states or has complex tax requirements, Wave does not support all state tax forms – this could put you at a competitive disadvantage.

To conclude this Wave review, I think the software offers a cost-effective payroll solution for small businesses, but even smaller businesses have employees spread out across the country that Wave doesn’t completely cater to given its lack of tax support in all states.