This review covers:

- Overview

- What Do Users Like About SurePayroll?

- What Don’t Users Like About SurePayroll?

- What Pricing Plans Does SurePayroll Offer?

- What are the Standout Features of SurePayroll?

- Positive User Feedback Highlights

- Negative User Feedback Highlights

- What are SurePayroll’s Ratings from Other Review Sites?

- What’s My Final Verdict on SurePayroll?

Overview

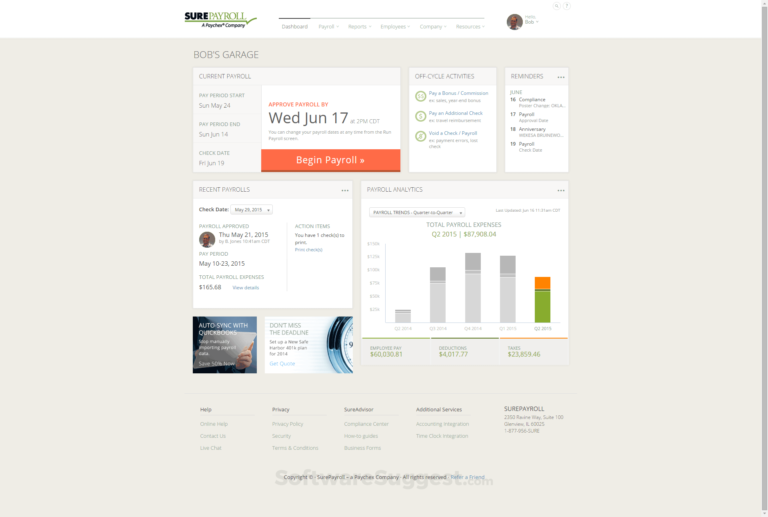

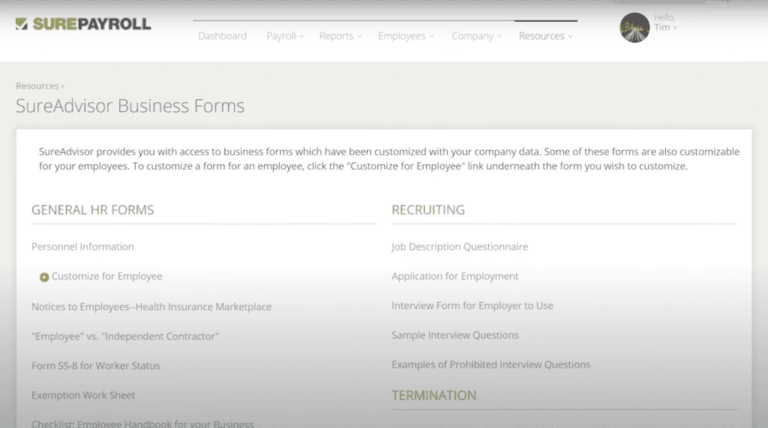

Let’s talk about SurePayroll, a payroll processing software that includes online payroll processing, direct deposit, employee self-service, and HR support. The software is affordable and I like that it comes with tax compliance features and also offers wage garnishments. Its automatic tax filings feature is also pretty neat.

Along with its mobile app, the software offers customizable reports that give valuable insights into payroll and employee data. I also find customer support to be up to the mark, with live chat, phone, email, and a comprehensive online help center at your disposal.

Plus, with reminder emails for upcoming payroll deadlines, you’ll never miss a beat when it comes to complying with payroll regulations.

But, some users have reported that the lack of customization options is annoying, which I feel could be improved. But what stands out to me the most is SurePayroll’s Android app, which has a really poor rating of 2.8/5 stars – bad news for Android users. Lastly, I also think the onboarding process is made to be more complicated than it needs to be.

Read on to discover more about SurePayroll and what it has to offer.

What Do Users Like About SurePayroll?

- User-friendly interface

- Good customer support

- Easy employee payroll

What Don’t Users Like About SurePayroll?

- Limited customization options

- Mobile app freezes

- Difficult onboarding process

What Pricing Plans Does SurePayroll Offer?

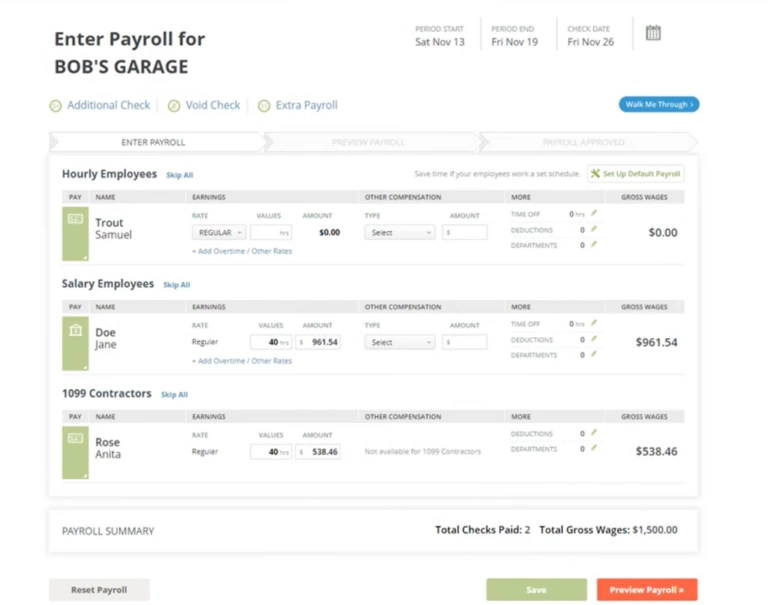

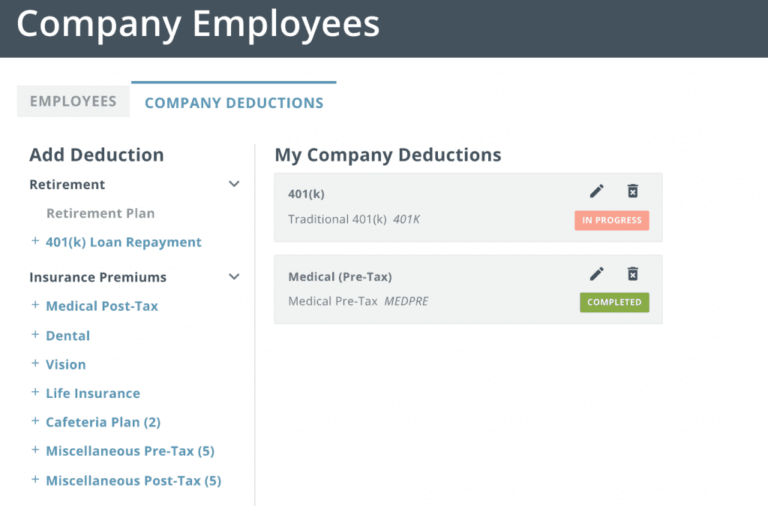

SurePayroll offers two plans, Full-Service and No Tax Filing. They both have deductions for Social Security, Medicare, unemployment, state, and local taxes, multiple pay rates & bonuses, unlimited payroll runs, direct deposit and online pay stubs, flexible payroll options including auto payroll, and US-based customer service. However, they also have very important differences, as discussed below.

Full-Service Payroll: This plan is for businesses that want to outsource their entire payroll process. SurePayroll will handle all aspects of your payroll, including tax filing, employee onboarding, and HR support. Pricing varies depending on your specific needs.

No Tax Filing Payroll: This plan is designed for the calculation of employee paychecks, and handling of state-required new hire reporting, among others. Because getting this plan means you’re opting out of help for tax filing, it costs much less than the Full-Service plan, but pricing still varies depending on your needs.

What are the Standout Features of SurePayroll?

1. Contractor payments

SurePayroll’s contractor payments feature offers businesses a convenient and secure online payment method for their contractors. The feature caters to various payment preferences with support for both direct deposit and checks. At the end of the year, the feature automatically generates 1099 forms. Contractors also benefit from the feature by easily accessing their payment history and records from the SurePayroll platform.

2. Garnishment payment processing

SurePayroll’s garnishment payment processing allows businesses to process wage garnishments accurately and efficiently. The platform calculates the garnishment amount based on the employee’s disposable income and handles payments to the appropriate agency or creditor. It also ensures compliance with court-ordered requirements.

3. Automatic payroll tax filings

SurePayroll’s automatic payroll tax filings automatically file federal, state, and local payroll taxes on behalf of businesses. In addition, SurePayroll provides businesses with detailed reports on their payroll taxes, including a summary of tax liabilities, deposit due dates, and payment history.

4. Reporting and Statistics

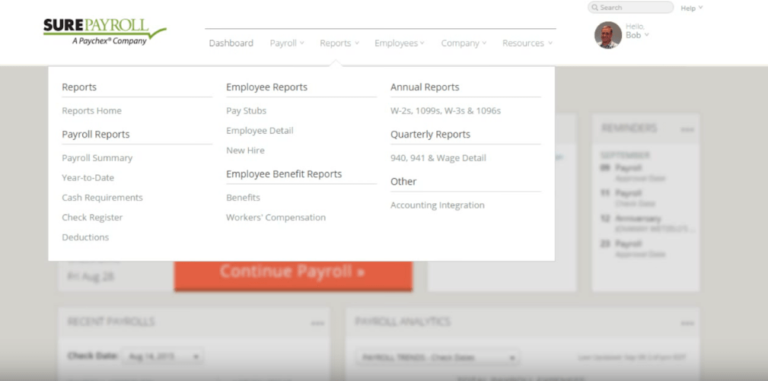

SurePayroll provides customizable reports, payroll history, tax liability, labor distribution reports, as well as automatic generation of tax forms for quarterly and year-end filings. With compliance reports, small businesses can easily track and analyze their payroll data while ensuring compliance with labor laws.

Selected Positive User Feedback:

- “Customer service is unparalleled! The main reason I left on pay. When I call in, even if I get the wrong person they try to help me. There’s no hurry to get rid of the call.” – Michael S. (Source App Store)

- “SurePayroll is easy to set up and use. After setting up your account, you can easily run a Payroll in under 3 minutes. There are many options for automatic payroll as well. It also provides a portal for your employees to receive their pay stubs and tax forms.” – Sudesna L. (Source G2)

- “It is easy to use, even as a small business owner, that is busy wearing so many other hats. There is also lots of online HR support to assist with questions. The help has been consistent throughout the year, even when issues arise.” – Dalin R. (Source G2)

- “They have been very good for our simple payroll needs. They have good pricing as well. We have been very happy with the service overall.” – Lisa K. (Source G2)

- “Intuitive and easy to use. The best though is that the online/telephone support is excellent, to the point of scanning/sending tax notices and SurePayroll takes care of the rest!” – Andy N. (Source G2)

- “Price and ease. It is very easy to use the platform and amend the payroll if mistakes are made. I have used SurePayroll in the past and other platforms since then, so when I started my company, I knew who I wanted to utilize for payroll services” – Sarah N. (Source G2)

- “It is very user-friendly. I seldom if ever need any technical assistance, but when I have it was easy and the person helping me was extremely knowledgeable.” – Wendy C. (Source Capterra)

- “This software has enabled us to be free of so much time. We used to do payroll manually and it would take 4-6 hrs.” – Melinda K. (Source Capterra)

- “This software is inherently easy to use and understand. The monthly fees are very low. The customer service is exceptional.” – Verified Reviewer (Source Capterra)

- “I like it is simple, I can have direct deposit, I can get clear reports and tax compliance. It is also reasonably priced.” – Joan C. (Source Capterra)

- “I like the fact that everything is done online and there’s really no need for phone communication unless there’s a problem.” – Lisa B. (Source Google Play)

- “They have relatively easy-to-use UI and nothing else” – Shakir A. (Source G2)

- “I really like the reminder emails so that I don’t forget to enter the information necessary for the payroll to be processed. I also really like that they take care of the necessary filings for all employee withholdings and tax payments.’ – Letitia P. (Source G2)

- “This is easy to use whether it is online or in the app. It takes me minutes to run payroll at most! User-friendly, great support if I have questions, and easy for my employees to use.” – Andrea E. (Source Capterra)

- “They send out emails to remind you to enter payroll every week. Payroll is on default and so easy to enter or make changes.“ – Keith H. (Source Capterra)

Selected Negative User Feedback:

- “App shows an error message “subject not set to an instance Of an object” (or something very close to that wording). It won’t let me do anything on the app.” – Crossjd03 (Source App Store)

- “The only problem I have with SurePay is if you need to get your payroll in before a holiday and it’s paid a day later than normal and you need it processed sooner, there’s a fee of approximately $65.” – Garyfree (Source App Store)

- “Horrible app! The fact that my company won’t ditch this app makes me want to ditch my company.” – Jamie (Source Google Play)

- “App doesn’t work 80% of the time. Freezes at the login screen. Won’t log in even when UN and PW are correct. Super buggy.” – Jourdan McCourt (Source Google Play)

- “Crashes consistently at biometric login. I have never been able to change or reset the username or password, respectively. Incredibly buggy and frustrating to work with.” – Stefanie Hudgens (Source Google Play)

- “Some dropdown lists for (rates and other compensations) should update automatically after changes are made to the company settings.” – Andrian M. (Source G2)

- “Onboarding can be painful if you are a new small biz because you are dealing with a national company – you have to find all your state tax ids on your own.” – Ivery R. (Source G2)

- “SurePayroll lacks a fully developed “ticket system” to track questions and requests for tax department rate changes.” – Verified Reviewer. (Source G2)

- “A little expensive for small businesses.” – Venketa D. (Source G2)

- “They have a glitch in the system that has to do with separating direct deposits for one person into two checking accounts.” – Keith H. (Source Capterra)

- “Limited customizations. There were a few occasions where reports were not made properly to the tax entities and we received notices from those entities.” – Shannon M. (Source Capterra)

- “Start-up was a little confusing at first. Onboarding is tiring. Good people are there to guide us through.” – Dick H. (Source Capterra)

- “I suppose the learning curve to use the software could be lessened by tutorials or other resources so that I don’t have to call customer support as much.” – Devin Q. (Source Capterra)

- “I have to enter a one-time code every time I log in as an administrator even though I check the box that I want the application to remember me and not prompt me for this level of security.” – Mark M. (Source Capterra)

- “Manual checks cause the payroll schedule to be off, and it has to be rebuilt. Not hard to do, but it shouldn’t happen.” – Tammie C. (Source Capterra)

- “Reports can not be customized and there are limited standard reports.” – Tina T. (Source Capterra)

What are SurePayroll’s Ratings from Other Review Sites?

(As of December 2023)

- Capterra: 4.1/5

- G2: 4.4/5

- Google Play: 2.8/5

- App Store: 4.7/5

- Get App: 4.1/5

- Software Advice: 4.1/5

What’s My Final Verdict on SurePayroll?

SurePayroll by Paychex is a cloud-based payroll processing service for small businesses. It offers features such as tax compliance, legal requirements, payroll calculation, and direct deposits. And let’s not forget, it can even integrate with various time clock companies for seamless time tracking.

With SurePayroll, you won’t have to worry about calculating federal, state, and local taxes as it does that for you automatically. Plus, what I really like is it offers flexible payroll processing options, including next-day and same-day processing. That means you can get your payroll done quickly and efficiently, leaving you with more time to focus on your business.

But wait, there’s more! SurePayroll isn’t just limited to payroll processing. It also offers solutions for managing 401(k) plans, health insurance, workers’ compensation, and employee screening – super convenient.

However, its lack of customization options is inconvenient for businesses with specific payroll needs. Also, the mobile app tends to freeze at irregular intervals and has a poor rating of 2.8/5 stars on the Google Play Store. Further, it has a steep learning curve involved in the onboarding process, which makes it challenging to get started. The additional fees for HR support can also make the service less affordable for some businesses.

To conclude, SurePayroll is a viable tool for small businesses. It offers flexible payroll processing options and various solutions for managing benefits and compliance. However, I believe factors such as the size of the business, the complexity of its payroll processes, and the need for smooth-functioning mobile apps to use on the go should be taken into account before making a decision.