This review covers:

- Overview

- What Do Users Like About Square Payroll?

- What Don’t Users Like About Square Payroll?

- What Pricing Plans Does Square Payroll Offer?

- What are the Standout Features of Square Payroll?

- Positive User Feedback Highlights

- Negative User Feedback Highlights

- What are Square Payroll’s Ratings from Other Review Sites?

- What’s My Final Verdict on Square Payroll?

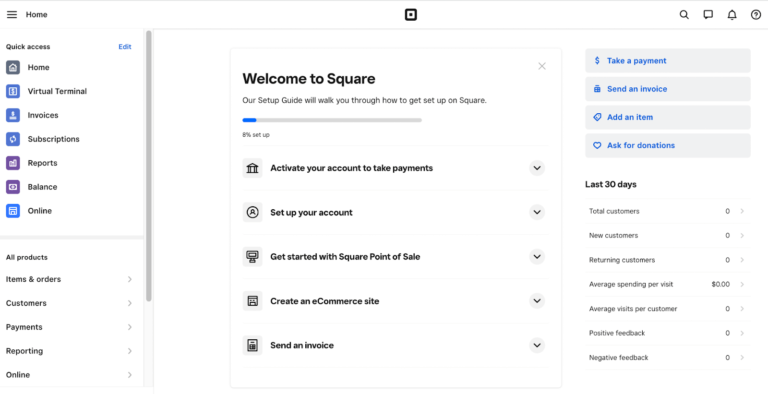

Overview

Square is a fintech company that provides various software and hardware tools for businesses, including point-of-sale systems, payment processing, payroll services, and online store management. One of Square’s popular software products is Square Payroll – a payroll management software that automates tax calculations, payments, and filings for businesses.

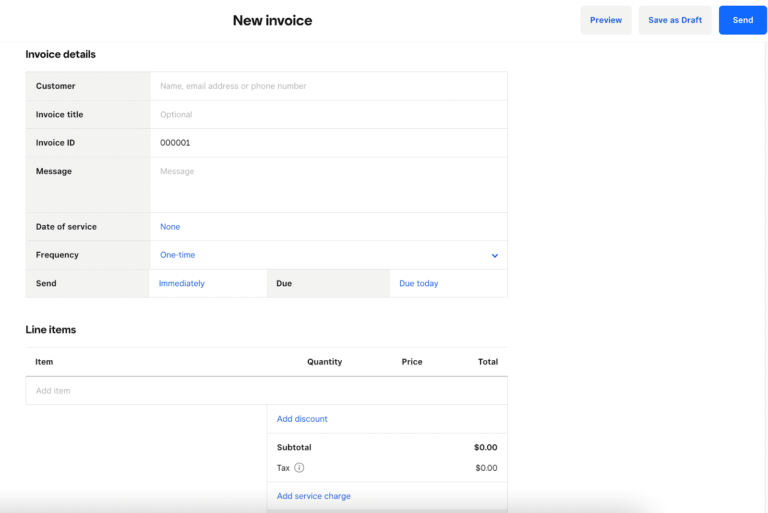

It covers all 50 states and works well with Square products and other third-party apps. What’s valuable is that it has added features like reporting, time tracking, and invoicing, which can be super helpful.

Square’s suite also includes an app called Square Team that helps businesses manage team members and their information, submit forms, and access pay stubs and tax info. The app is pretty great for supervisors too, as it helps them create schedules and disseminate work more efficiently. And with Square Payroll, you can automatically deduct benefits like health insurance and retirement plans, which keeps you in compliance with state and federal regulations.

But, it’s a bummer that it doesn’t offer 24/7 customer support, and its integration options are limited. Additionally, what I don’t like is that it doesn’t offer a manual payroll option.

What Do Users Like About Square Payroll?

- Operates in all 50 states

- Integrates with Square products and third-party apps

- Comprehensive online payroll services

- No base fee for the contractor-only plan

- Free migration from former software

What Don’t Users Like About Square Payroll?

- Limited reporting

- No free trial

- Lack of customization

- Limited customer support

What Pricing Plans Does Square Payroll Offer?

Square Payroll offers two pricing plans for its payroll services:

Pay Employees & Contractors: At a base fee of US$35/month and $6/user/month, this plan includes unlimited monthly pay runs, automatic payroll tax calculations, tax filings and payments, multistate payroll, timecards and employee apps, and support for tracking tips and commissions.

Pay Contractors Only: At a base fee of $6/user/month, this plan includes unlimited monthly pay runs, support for paying by check, direct deposit or Cash App, and mailing all 1099-NEC forms.

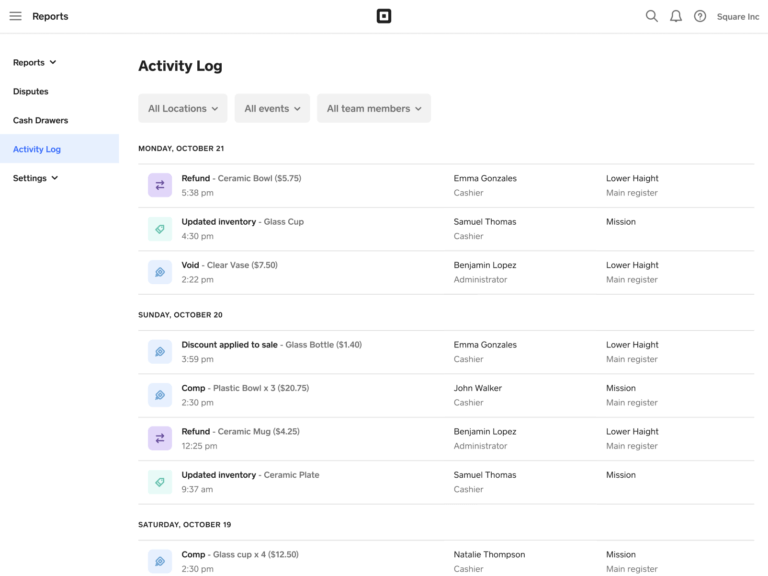

What are the Standout Features of Square Payroll?

1. Employee management

The Square Team app enables team members to establish online accounts to modify their personal data, complete W-4 forms, oversee their pay stubs and bank accounts, and review their tax information. Supervisors can also generate and disseminate work schedules via the app. At the same time, employees and independent contractors can punch in and out, allowing the app to monitor hours worked, calculate payments, and factor in variables such as overtime, paid time off (PTO), and other earnings.

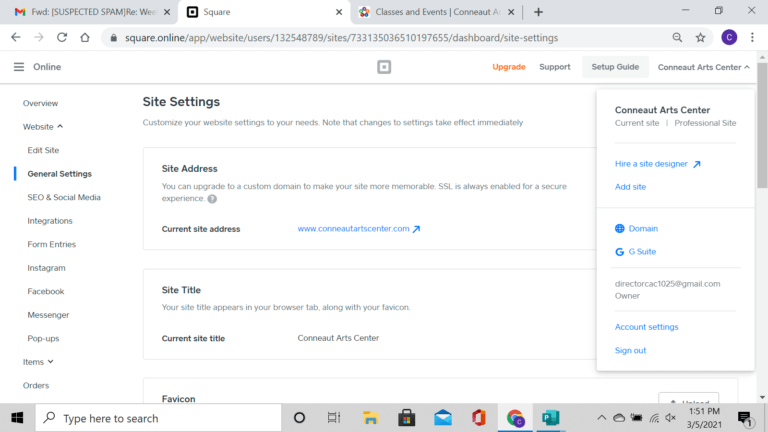

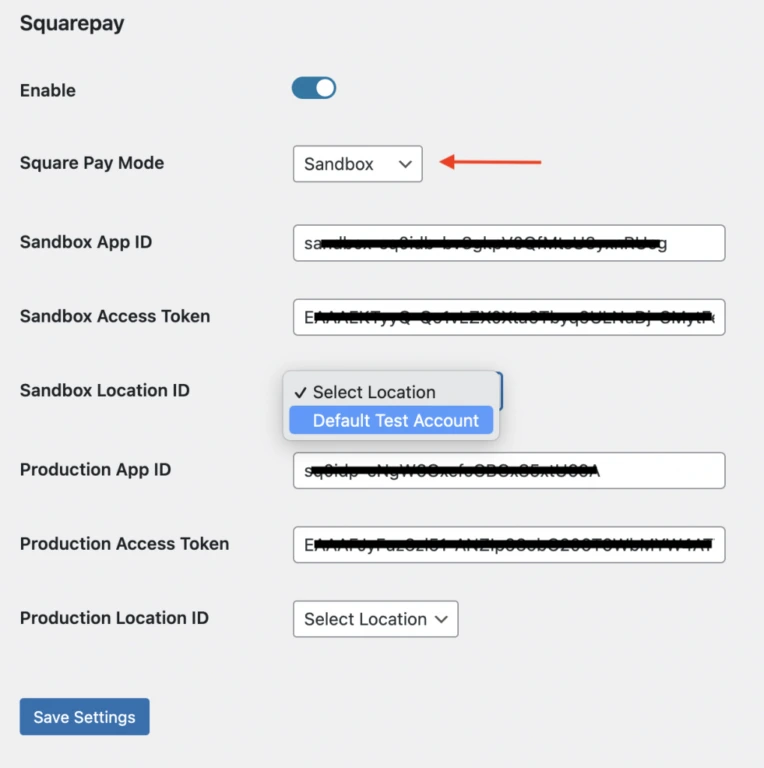

2. Third-party integrations

Square Payroll seamlessly incorporates Square POS, Homebase, QuickBooks Online, and AP Intego to facilitate and optimize payroll and accounting operations for businesses. These integrations enable enterprises to import time cards and tips, synchronize employee schedules and timecards, automatically harmonize payroll data, and efficiently register for workers’ compensation insurance.

3. Benefit deductions and company contributions

Square Payroll manages benefit deductions and company contributions. It automates deductions for benefits, such as health insurance and retirement plans, and enables employers to contribute to these benefits. It also ensures compliance with federal and state regulations by automatically calculating taxes and providing customizable reports on benefit deductions and company contributions.

4. Tax support

Square Payroll prioritizes adherence to state tax regulations and withholdings, ensuring a seamless and comprehensive payroll process that prevents potential entanglements with governmental agencies. The service computes the applicable federal, state, and local taxes for every staff member and independent contractor using pertinent information. In addition, it takes responsibility for generating, filing and transmitting requisite forms such as 1099 and W2 on your behalf. Further enhancing convenience, employees can obtain and sign tax forms while accessing their pay stubs via their mobile devices.

Selected Positive User Feedback:

- “I like square payroll because it is extremely easy to use and has never given me an issue.” – Katie P. (Source G2)

- “Well integrated, easy to use and sends notifications to remind you to run payroll at the right time.” – Charles F. (Source G2)

- “By using the Square POS system, our employees’ timecards will automatically sync with the Square Payroll app.” – Verified User in Education Management (Source G2)

- “It is very easy to sign into and takes less than 5 seconds of my time.” – Misty S. (Source G2)

- “I loved the fact that all taxes and forms were paid and submitted automatically after setup.” – Alysse S. (Source G2)

- “Easy ways for employees to clock in and out.” – Verified User in Retail (Source G2)

- “Made it easy to see how much I made and got my paycheck fast.” – Verified User in Food and Beverages (Source G2)

- “I can easily edit an employee’s hours if they made a mistake on their time card.” – Long J88 (SourceApp Store)

- “It is so easy to use, either on the computer or mobile phone. Very inexpensive compared with Paychex and ADP.” – Mathew H. (Source Capterra)

- “Easy to use, reporting is exactly what I need.” – Laura Lee P. (Source Capterra)

- “I loved that this was plug and play ready, user friendly and made payroll less of a headache.” – Chandra D. (Source Capterra)

- “I like that it is so easy to charge our customers and I also like that we can create invoices, emails, feedback, etc.” – Johny L. (Source Capterra)

- “Square payroll makes such a complicated and time-consuming task or managing payroll a simple task .” – Harold U. (Source Capterra)

- “The ease of use and setup of Square Payroll was incredible.” – Bryan H. (Source Capterra)

- “It is also one of the least expensive payroll options out there.” – DuWayne H. (Source Capterra)

Selected Negative User Feedback:

- “There are times that the software gets glitchy when people punch in and/or out.” – Erica S. (Source Capterra)

- “it does not do the HR items that Paychex and ADP do” – Mathew H. (Source Capterra)

- “My biggest pet peeve is the inflexibility of making tax adjustments.” – Kristan B. (Source Capterra)

- “You cannot pull different location’s payroll from different bank accounts, square only allows one bank account for payroll.” – Sarah J. (SourcE Capterra)

- “The only real issue is adding a New employee.” – Roger T. (Source Capterra)

- “I wish there was a way to set up a one-time subtraction from someone’s paycheck.” – Peter F. (Source G2)

- “I dislike the limitations on customization within the Square Payroll app and no free-trial.” – Katie P. (Source G2)

- “It is difficult to fix time cards when you make mistakes. Customer representative isn’t availbale most of the time.” – Misty S. (Source G2)

- “I wish that there would be a free-trial and contractor payout could process a little faster than it does.” – Amanda M. (Source Capterra)

- “So much set up and even when you move over a section it continues to show it when you haven’t and don’t plan to complete it.” – Caleb C. (Source G2)

- “The hidden fees. They tell you it’s $5 to get started but ends up about $35 a month.” – Verified User in Retail (Source G2)

- “The app has issues. If pay amount differs from “regular” the change will not save and it has to be done from a computer.” – Google User (Source Google Play)

- “They clock out and the app doesn’t clock them out until hours later. Customer support is only available on business hours.” – Caiss (Source App Store)

- “the web app seems to fail login from safari no matter what even when I use the correct password.” – Danial Jackson (Source App Store)

What are Square Payroll’s Ratings from Other Review Sites?

(As of December 2023)

- Capterra: 4.6/5

- G2: 4.2/5

- Get App: 4.6/5

- Software Advice: 4.5/5

- App Store: 3.8/5

- Google Play Store: 3.6/5

Final Thoughts

Square Payroll is an online payroll software that does all payroll tasks and keeps track of employee data.

With this software, you can automate your payroll processes and say goodbye to the headaches of manual calculations. Plus, it offers integration capabilities with accounting software like QuickBooks Online, making your life even easier.

But that’s not all! It also comes with additional features like reporting, time tracking, and invoicing. And if you’re a supervisor, you’ll love the employee management tools provided by the Square Team app. It allows team members to modify data, complete forms, and oversee pay stubs, bank accounts, and tax information. You can even generate work schedules quickly and efficiently.

Now, I have to admit that Square Payroll has limited integration options and lacks a comprehensive HRM suite like other payroll software. And if you need customer support outside of business hours, you might be out of luck. Plus, if you’re not into manual payroll processing, you might be disappointed to learn that it doesn’t offer a manual payroll option.

Overall, Square Payroll is a solid payroll software for businesses, however, the platform’s inaccessible customer support outside of business hours hinders businesses that operate during different time zones.