This review covers:

- Overview

- What Do Users Like About FreeAgent?

- What Don’t Users Like About FreeAgent?

- What Pricing Plans Does FreeAgent Offer?

- What are the Standout Features of FreeAgent?

- Positive User Highlights

- Negative User Highlights

- What are FreeAgent’s Ratings from Other Reviews

- What’s My Final Verdict on FreeAgent?

Overview

Let’s talk about FreeAgent, a cloud-based accounting software made specifically for freelancers, small business owners, and their accountants. It offers a variety of features such as estimates, invoicing, expenses, payslip generation, automatic tax and National Insurance calculations, and HMRC compliance. It also has a mobile app that allows users to take work wherever they go.

FreeAgent goes above and beyond with additional functionalities like pension auto-enrolment, time off management, user permissions, and access control. And the best part – with its intuitive and user-friendly interface, you’ll be up and running in no time, without any specialised knowledge or training.

In addition to that, FreeAgent seamlessly integrates with other FreeAgent modules like time tracking, expenses, projects, and insights so you can keep all your financial ducks in a row, which I really appreciate. Plus, it’s got your back when it comes to banking and tax compliance. With automatic integration with banking API feeds and HMRC for VAT and self-assessment forms, you’ll be sailing through tax season with ease.

Another thing I like about FreeAgent is its cash flow forecasting and dashboard overview. FreeAgent’s powerful tools allow business owners to have a clear and accurate picture of how their company is doing.

Now, I promised an honest FreeAgent review, so I must also discuss its downsides. I find FreeAgent to be a bit more expensive compared to some other accounting software options. Plus, the UI for viewing current expenses is a bit clunky. And to cap it all off, the mobile app could use some improvements to catch up with the web version.

But that’s just the tip of the iceberg, and there’s lots more to know about FreeAgent. It’s only fair that we should explore what else it has to offer before making any judgments. So, without further ado, let’s dive right into this FreeAgent review.

What Do Users Like About FreeAgent?

- Automatic integration with banking API feeds

- User-friendly interface and easy to navigate

- Templates for sending invoices

- VAT and SA form integration with HMRC

- Cash flow forecasting and dashboard overview

What Don’t Users Like About FreeAgent?

- Clunky UI for viewing recent expenses

- Expensive

- Limited features

- Mobile app lacks features and options of the web version

What Pricing Plans Does FreeAgent Offer?

FreeAgent offers a Universal plan for small businesses. It offers features such as estimates and invoicing, expenses, time tracking, banking, projects, sales tax reporting, multi-currency invoicing, receipt scanning, and user-friendly dashboards, among a host of others. The regular monthly subscription is at $20, but new customers get a 50% discount for their first six months if they pay for 12 months up front.

In addition to the Universal plan, FreeAgent also offers an add-on called Smart Capture Unlimited which allows unlimited use of the receipt scanning tool for $6 per month.

FreeAgent does not offer any free plans, but users wanting to test out the system may avail of the 30-day free trial period.

What are the Standout Features of FreeAgent?

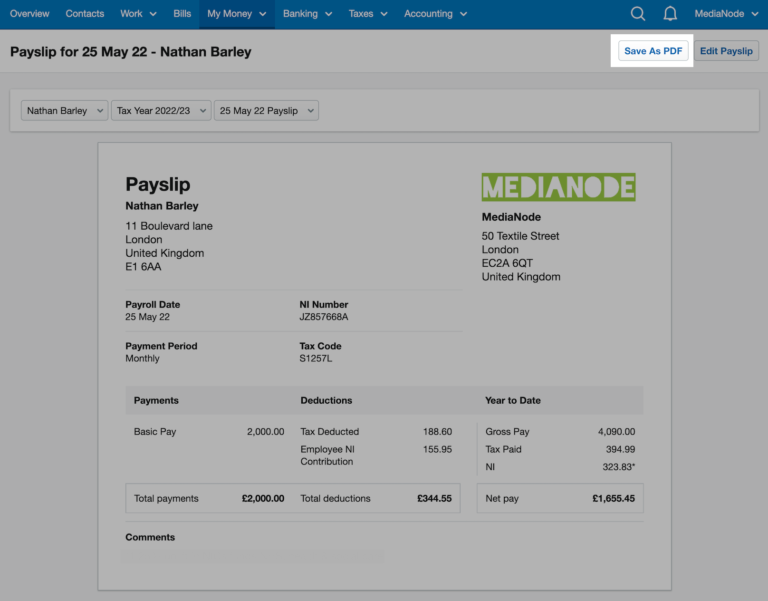

1. Automatic Tax and National Insurance (NI) Calculations

FreeAgent automatically calculates taxes and National Insurance contributions based on the user’s inputs and the latest HMRC rules. The calculations consider employee salaries, tax codes, and NI thresholds. Users can also make adjustments as needed and generate reports to keep track of tax and NI payments.

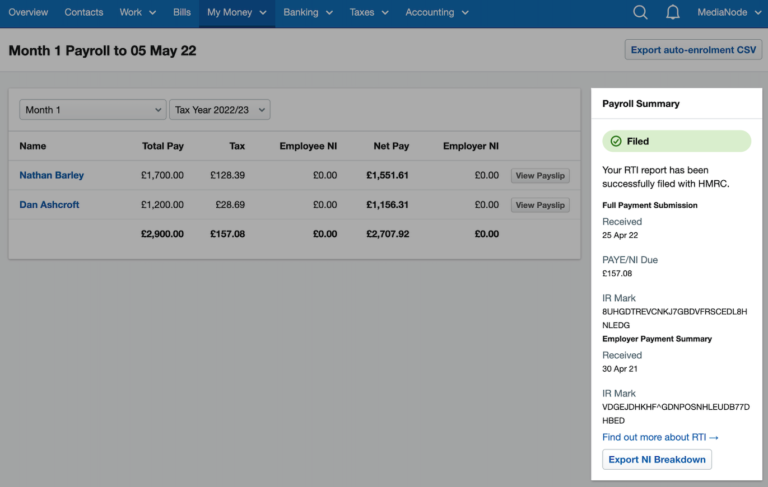

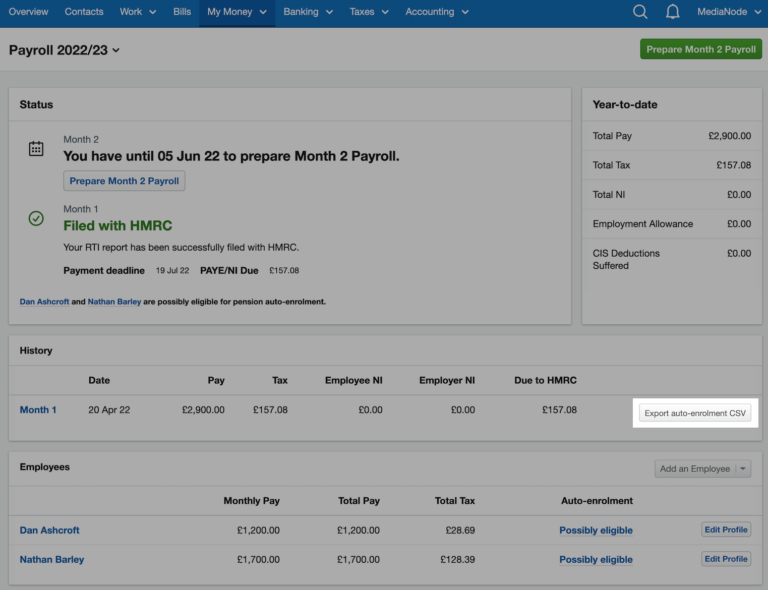

2. RTI (Real Time Information) Submissions to HMRC

FreeAgent enables users to submit Real Time Information (RTI) directly from the platform to HMRC. This includes submitting information on employee wages, taxes, and National Insurance contributions in real-time, as UK law requires. Users also receive notifications when submissions are completed.

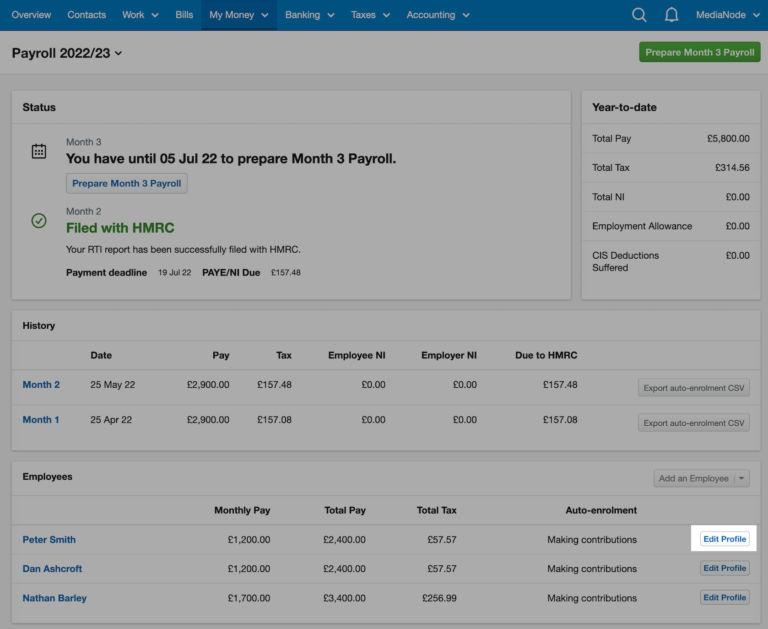

3. Pensions Auto-enrolment

Pensions auto-enrolment allows users to enroll their employees in a workplace pension scheme and automatically calculate contributions based on employee earnings. This feature also includes communicating with pension providers, generating reports, and managing opt-outs and refunds.

4. Payslip Generation and Distribution

FreeAgent’s payslip generation and distribution feature allows users to generate and distribute payslips for their employees directly from the platform. This includes the automatic calculation of taxes, National Insurance contributions, and other deductions, as well as the ability to customise payslips with company logos and other details. Payslips are distributed electronically or in print, and users can set up recurring payslips for ongoing employee payments.

Selected Positive User Feedback:

- “I love it, so easy to use and share all information with my accountant with great ease, all linked with my banking so I can check and see everything in one place.” – Stitchybuckle (Source App Store)

- “I use the FreeAgent mobile app daily and it’s a big, big timesaver for me. Being able to handle some of the frequent tasks away from my desk gives me uninterrupted time to focus on work when I am at it so it’s a valuable tool for me.” – Woowoo_creative (Source App Store)

- “FreeAgent keeps all my accounting and bookkeeping records in one easily accessible place. I use it to maintain invoices, debtors, bills, vat, estimates, bank transactions and profit and loss. I like the cash flow forecasting and the dashboard overview of my business’s accounts.” – Laura G. (Source G2)

- “Very intuitive and helpful features that mean it is possible for small companies to complete most accounting tasks in house.” – Sam C. (Source G2)

- “This platform is ideal for finance because it helps manage expenses, payroll execution, invoice creation and delivery, and provides workflow control over business successfully, this will help increase business processes and obtain better results during sales in the process, it also contains a good variety of functions and a fantastic customer service.” – Ernesto C. (Source Capterra)

- “Love the ease of use, simple to learn, and has most of the great features such as Quick Books, Xero, Sage. FREE to RBS business users!!” – Jillian F. (Source G2)

- “It is a very effective service to help keep accounts, manage expenses, and follow up on the time of payment or collection of accounts, it is great because it allows you to have a secure order and allows you to obtain control over the accounts and each movement on the expenses that have been executed.” – Sarah B. (Source G2)

- “I like that there are a lot of different features to this website. FreeAgent has a lot of great features for small businesses. I own a small business and FreeAgent has a lot of useful tools that I can use for my business.” – Laura B. (Source G2)

- “One of the biggest pros of FreeAgent is its user-friendly interface. The dashboard is well organized and easy to navigate, making it simple to stay on top of our financials and track expenses. Another advantage of FreeAgent is its robust feature set.” – Kavindu Githsara (Source Capterra)

- “The greatest thing about FreeAgent is the ease of bookkeeping, being able to have any bank transactions and PayPal transactions automatically put into bookkeeping form and easily explain what each transaction is, whether it’s a sale or stock purchases.” – Terrum W. (Source Capterra)

- “I was pleasantly surprised by how easy it is to use FreeAgent. I would say the user interface and functionality are more intuitive than Xero. The best thing is, the software is free if you have a business account with NatWest or Mettle.” – Lola R. (Source Capterra)

- “It’s straightforward, easy to set up and use. Everything you need to manage your accounts is in plain sight rather then you needing to know there is a completely different process somewhere else that actually needs to be completed. The processes are quick and easy to work out.” – Jane H. (Source Capterra)

- “Easy to use. Easy to find what I want. Brilliant support.” – Chris W. (Source Capterra)

- “It’s useful to be able to see the state of my business finances at a glance and it’s great to be able to send professional invoices – but it’s a lot of money for an invoice template.” – Steve B. (Source Capterra)

- “Auto integration with banking API feeds * Intelligent learning for your regular banking transactions. Templates for sending invoices etc and VAT & SA form integration with HMRC” – Rouska L. (Source Capterra)

Selected Negative User Feedback:

- “Slightly clunky UI for viewing recent expenses. Inability to remove users who have left the business” – Rouska L. (Source Capterra)

- “One major drawback is that you can’t print out a consolidated tax return before or after filing.” – Verified Reviewer (Source Capterra)

- “Doesn’t integrate with newer online style bank accounts for automated feeds at all. (e.g. transfer wise bank accounts) . Sometimes doesn’t recognize recurring bank transactions meaning it takes longer to explain” – David K. (Source Capterra)

- “The mobile app is not as feature-rich and some of the functionality that it does have does not share the same options as the web version e.g. split transactions.” – Verified Reviewer (Source Capterra)

- “Sometimes it freezes and it disconnects from the cloud.” – Sophie W. (Source Capterra)

- “We know from our accountant that while its great for us users, the interface is not so great for them.” – James K. (Source Capterra)

- “It is difficult to export information (if you need it in the CSV format). Expensive when compared to other accounting solutions.” – Anil J. (Source Capterra)

- “It would be great if there was some kind of front-end graphical dashboard.” – Ajit R. (Source Capterra)

- “Some features of FreeAgent are still very buggy, such as the automation of transactions.” – Terrum W. (Source G2)

- “The one thing that I just like about FreeAgent Is when you’re on your mobile phone on your account the screen print is very small because there’s a lot of information so there’s a lot of zooming in and out on her mobile phone.” – Laura B. (Source G2)

- “The price is perhaps slightly higher than some comparable software.” – Verified User (Source G2)

- “Its scope is limited, this tool is designed for small companies, so wanting to apply it in a medium or large company may not currently be possible since it would fall short in terms of performance.” – Vera H. (Source G2)

- “iPhone App lacks some functionality and there is no IPAD app enabled.” – Mike H. (Source G2)

- “FreeAgent is very clumsy and clumsy to use. It is very expensive for what it is and definitely not worth using for free. There are several essential basic functions missing and it is very restrictive/prescriptive that forces you to work your way or not.” – Jay B. (Source G2)

- “Weirdly, I find the expense reporting a bit tricky to set up.” – Sameul G. (Source App Store)

What are FreeAgent’s Ratings from Other Review Sites?

(As of January 2024)

- Capterra: 4.6/5

- G2: 4.3/5

- GetApp: 4.4/5

- App Store: 4.8/5

- Google Play Store: 4.5/5

- Software Advice: 4.4/5

- TrustRadius: 8.1/10

What’s My Final Verdict on FreeAgent?

FreeAgent is a cloud-based accounting and payroll software solution that offers a respectable suite of features. It takes the headache out of payroll processing with features like automatic tax and National Insurance calculations, payslip generation, and HMRC compliance. And it doesn’t stop there — it also offers additional functionalities such as pension auto-enrolment, time off management, and user permissions to ensure that businesses manage their payroll effectively.

FreeAgent’s dashboard overview and cash flow forecasting features also provide invaluable insights into a business’s financial health. Plus, the software’s user-friendly interface automatically integrates banking API feeds and offers templates for sending invoices.

However, the mobile app falls short when compared to the web version features-wise, and I find FreeAgent’s regular pricing expensive compared to other options. Plus, the platform’s user interface can be a bit clunky when viewing recent expenses, and it may not offer some advanced functions that larger businesses require.

To conclude, FreeAgent caters well to small businesses and freelancers through its seamless accounting and payroll integration. However, businesses on a budget might want to consider cheaper options that are a good alternative to FreeAgent.