This Review Covers:

- Overview

- What Do Users Like About Clear Books?

- What Don’t Users Like About Clear Books?

- What Pricing Plans Does Clear Books Offer?

- What are the Standout Features of Clear Books?

- Positive User Highlights

- Negative User Highlights

- What are Clear Books’ Ratings from Other Review Sites?

- What’s My Final Verdict on Clear Books?

Overview

Let’s talk about Clear Books, an online payroll and HR software designed to assist small to medium-sized businesses in the UK.

Clear Books is a cloud-based accounting software that is accredited by The Institute of Certified Bookkeepers and registered with the Financial Conduct Authority. It promises to minimize the time and efforts spent on payroll processing by automating payment reminders, facilitating customized invoicing, and streamlining customers’ payments with various online payment options, and harnessing the power of AI lighten administrative and bookkeeping burdens.

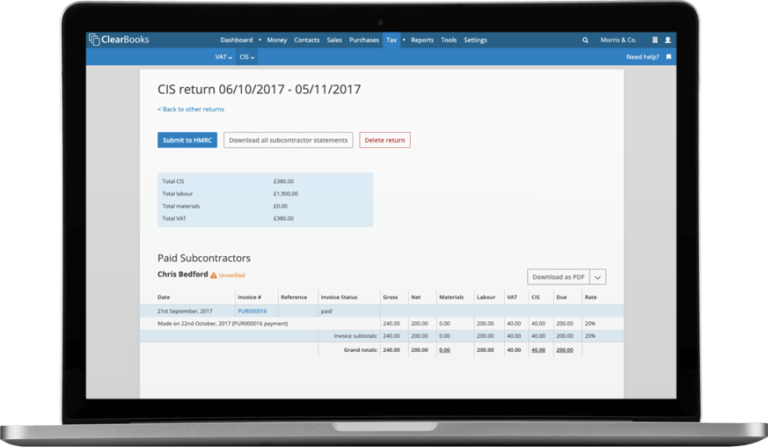

I particularly appreciate its wide range of capabilities that offer solutions not just for integrated payroll, but for multi-currency accounting as well. The inclusion of auto-enrolment, pension payments, and end-to-end CIS support also deserves to be mentioned.

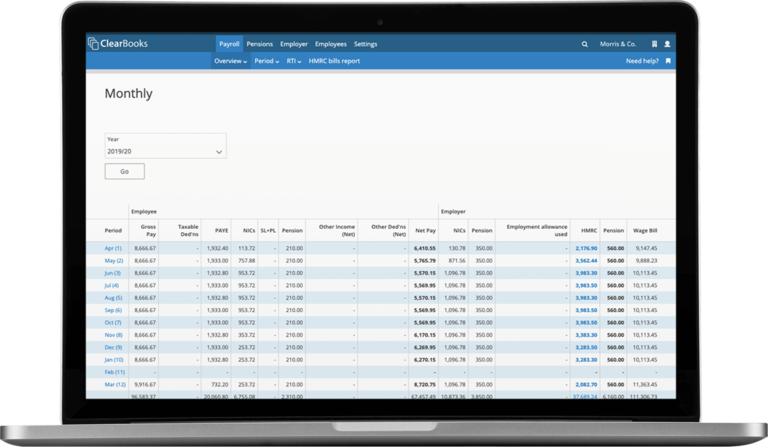

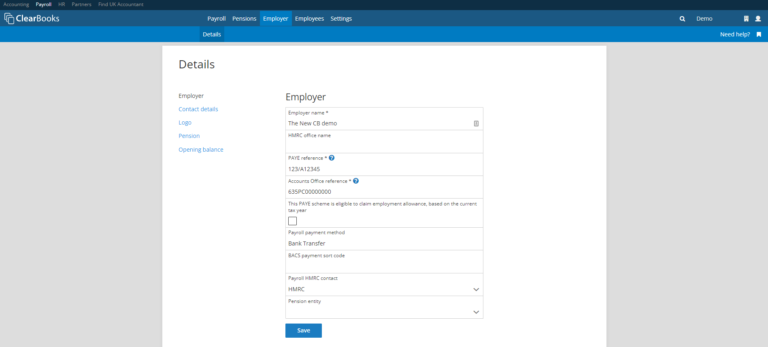

Another thing I like about Clear Books is that it allows users to claim the £4,000 employment allowance, which significantly reduces the amount of National Insurance contributions owed. The system automatically takes care of taxes and National Insurance contributions and generates detailed tax and accounting reports as well. In addition to that, I also find it effortless to input and manage employee information, pay rates, and other essential details using the system’s user-friendly interface.

Now, I could go on and on about the things that I like about the software, but I promised an honest Clear Books review so I must also discuss its shortcomings.

I think Clear Books could be more efficient if it automated some repetitive tasks that require manual entry by adding certain web API integrations — it already has some, but there are still processes where automation would be most helpful. It also lacks an auto-save button, which is just inconvenient if you ask me. In addition to that, I also think that not being able to customise document templates hinders companies from creating a more personalised experience.

That’s just the tip of the iceberg, and there’s a lot more that you should know about the software before making any judgments. So, without further ado, let’s dive right into this Clear Books review.

What Do Users Like About Clear Books?

- Customised invoicing and payment reminders

- Integrations with administrative and accounting functions

- Simple and easy-to-use interface

- Ability to send invoices by email

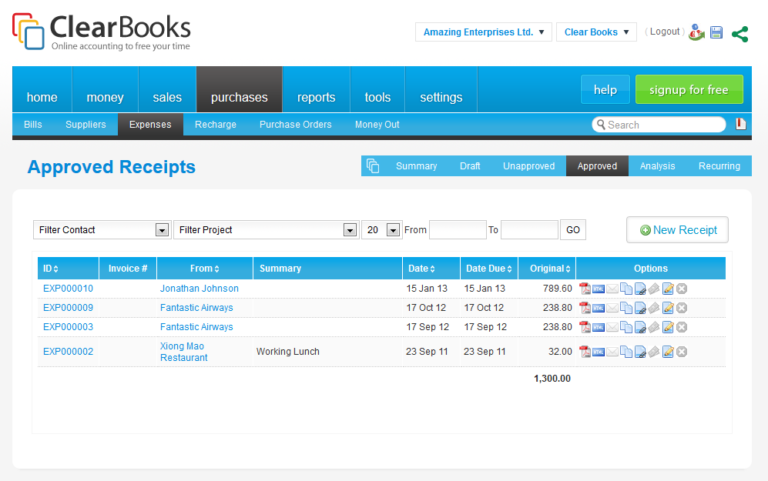

- Efficient tracking of accounts, expenses, and invoices with financial reports

What Don’t Users Like About Clear Books?

- Lacks auto-save function

- The software is slow at times

- Lack of add-ons

- Lacks certain web API integrations for the automation of repetitive tasks

- Data is not fully encrypted

What Pricing Plans Does Clear Books Offer?

Clear Books offers several plans that cater to all business sizes, including sole traders, limited companies and partnerships. Subscriptions can be on a monthly basis, annually, or every two years.

Small: This plan offers access to core Clear Books features, plus an invoice/quote creator, bill and receipt tracking, bank feeds and uploads, reports, and a dividends tool. Priced at £13.00 when billed monthly, they offer the first three months of usage at a discounted rate of only £6.50 per month. When billed annually, a 10% discount applies, bringing down the price to £11.70 per month, with the first three months at a discounted rate of only £5.85 per month. For a two-year plan, the discount increases to 20%, which brings down the price to only £10.40 per month, and the first three months also come discounted at only £5.20 per month.

Medium: This HRMC-recognized plan is the most popular among the selections and has all the features of the Small Plan, plus MTD VAT reporting and CIS. Priced at £28.00 when billed monthly, they offer the first three months of usage at a discounted rate of only £14 per month. When billed annually, a 10% discount applies, bringing down the price to £25.20 per month, with the first three months at a discounted rate of only £12.60 per month. For a two-year plan, the discount increases to 20%, which brings down the price to only £22.40 per month, and the first three months also come discounted at only £11.20 per month.

Large: Also HRMC-recognized, this plan has all the features of the two previous plans, plus all of the advanced features of Clear Books such as project accounting, multi-currency support, expenses, and fixed assets. Priced at £34.00 when billed monthly, they offer the first three months of usage at a discounted rate of only £17 per month. When billed annually, a 10% discount applies, bringing down the price to £30.60 per month, with the first three months at a discounted rate of only £15.30 per month. For a two-year plan, the discount increases to 20%, which brings down the price to only £27.20 per month, and the first three months also come discounted at only £13.60 per month.

Aside from those, Clear Books also offers an optional Payroll add-on starting at £2.70 per month for a minimum of two employees. For organizations with three employees or more, the add-on costs £1.35 per employee per month.

Other optional add-ons include Instant Bank Payments and Auto Bills. Prices for these can be obtained directly from Clear Books sales representatives.

Although Clear Books does not have any free plans, it offers a free 30-day trial period for users who wish to test out the system without the pressure of commitment.

What are the Standout Features of Clear Books?

1. Auto-enrolment and Pension Payment Management

Clear Books payroll includes a feature for managing auto-enrolment and pension payments, allowing businesses to handle workplace pensions and ensure compliance with government regulations. Users can set up auto-enrolment, manage pension contributions, and handle opt-outs, re-enrolment, and contribution levels.

2. End-to-end CIS Support

Clear Books payroll provides end-to-end CIS support for construction businesses, allowing them to manage their payroll processes in compliance with government regulations. The feature includes managing subcontractors’ details, generating payment and deduction statements, and producing CIS reports for HMRC. The system also calculates and deducts the appropriate tax and National Insurance contributions, ensuring accurate payments and compliance.

3. £4,000 Employment Allowance Claiming

Clear Books payroll has a feature that allows eligible businesses to claim the £4,000 employment allowance, reducing their National Insurance contributions and overall payroll costs. Users can check eligibility and claim the allowance through the platform, which automatically adjusts the employer’s contributions and ensures compliance with regulations.

4. Additional Pay Information Tracking

Clear Books payroll lets users track additional payment information, such as bonuses, commissions, and reimbursements, enabling businesses to maintain accurate records and generate insightful reports. This feature can be inputted manually or imported via CSV and automatically calculates taxes and deductions based on the employee’s pay rate and tax code.

Selected Positive User Feedback:

- “A businessman can easily use this software, without an accountant and full training just having some background in finance is needed. It can be integrated, and also has multi-currency access.” – Rashmi D. (Source G2)

- “Clear Books allows a comprehensive view of what your finances are for your business. The platform is scalable enough to where you can grow with the software and not have to wonder if you are going to need to get another software because you outgrew its capabilities. – Verified User(Source G2)

- “I like how I am able to get my financial information at all times that I need. Also with it, I am able to manage the billings and invoices more efficiently.” – Rocco P. (Source G2)

- “Provides an excellent option to control our financial information, since it has integrations with administrative and accounting functions that allow the issuance of complete reports in these areas. In addition, it provides a simple and easy-to-use interface that greatly facilitates its use by the management personnel of our company. ” – Hattie M. (Source G2)

- “Starting out fresh, I really needed strong accounts management for my company in order to keep an accurate record of the money invested and earned. I find using Clear Books just the right solution for my needs. It manages the billing, invoices and creates financial reports for my company very efficiently.” – Tannsi B. (Source G2)

- “The most beneficial thing about this software is that it provides us quantitative income and expenses information. With the help of Clear Books software we can efficiently incorporate and manage all of our expenditures and manage all of our customer invoices in a very short time. ” – Jennifer A. (Source G2)

- “The most significant thing about this software is that it can easily track the accounts, expenses, and invoices more efficiently. The other best thing about this software is that the invoicing system is really great and simple to use and you can easily customize and handle all accounts and other everything in a very easiest way. ” – Abdul A. (Source G2)

- “We had multiple contractors across 11 states and it was easy to see who was requesting company PTO.” – Verified User (Source G2)

- “With Clear Books, we create customized invoices simply and we set payment reminders that get us paid faster than before. In a glance we see what we owe our suppliers and contractors without much hassle.” – Amrita S. (Source G2)

- “Clear Books has a user-friendly interface that makes it easy for me to navigate and understand. The software is comprehensive, covering all aspects of accounting and finance, from invoicing to tracking expenses and generating financial reports.” – Kavinda Githsara K. (Source Capterra)

- “By using that accounting software, then we can sell all our sales and marketing products without any thinking about the invoices losses because Clear Books always provide its customer with full invoices and expenses profit.” – Verna B. (Source Capterra)

- “Stores customer information to make repeat billing easy. Links to bank account too.” – Tim T. (Source Capterra)

- “It has a panel through which you can control the most important aspects of your accounting, program reminders, and automate the payments you should make, another aspect that I like is your billing module, you can customize and adapt to your needs, manage the part.” – Andersen S. (Source Capterra)

- “Brilliant support. UK based. Responsive and reliable. Does everything I need and more. Good pace of new features and improvements.” – Verified Reviewer (Source Capterra)

- “It’s easy to use Cloud-based Bank import tool On-line filing Clear dashboard Multi-user Accessible by client and accountant Real-time information Send invoices by e-mail Upload scans of purchase invoices so that you don’t need paper copies.” – Martyn K. (Source Capterra)

Selected Negative User Feedback:

- “The software can be slow at times, causing frustration and slowing down my work. Additionally, the support system could be improved, as I have encountered a few issues where it took a while to get a response or resolution.” – Kavinda Githsara K. (Source Capterra)

- “Sometimes, due to accounts problems we cannot easily get all our invoices and expenses with the normal process.” – Verna B. (Source Capterra)

- “It is a little at the higher price range but you get what you pay for.” – Shaun J. (Source Capterra)

- “In general lines is a fairly complete software, however, I have noticed that it does not allow you to repeat certain tasks, that is, once a task is completed, you must re-program it again if you require it.” – Anderson S. (Source Capterra)

- “A few feature niggles but these are in the improvements queue I believe. It’s not immediately obvious that you can try out demo data in your free trial – I had to be told about this by a support person.” – Verified User (Source Capterra)

- “Needs more add-ons however when you raise an issue with Clear Books staff they usually respond quickly so I would expect to see some more soon.” – Martyn K. (Source Capterra)

- “There are functions on the platform that can be simplified to give the system better functionality.” – Tomas D. (Source Capterra)

- “They continually add UI changes, it’s not a huge deal, but almost every week they’ve changed some little thing. It can be annoying when you’re trying to figure out where things are. – They lack the web API integrations we need. This means that you can’t automate repetitive tasks such as creating quotes.” – Verified Reviewer(Source Capterra)

- “It is not fully encrypted, Data can be stolen by hackers. If it is not backed up properly, important data can be lost..” – Rashmi D. (Source G2)

- “Customer service is somewhat slow when giving their answers and on most occasions, they do not find the right answer to solve my problem. It does not allow the reuse of tasks, once a task is performed and if I want to perform it again with new parameters, instead of editing the information I must create a new task from scratch, which is somewhat tedious to perform.” – Hattie M. (Source G2)

- “When you input too many lines in a bill the package can lock and you have to start from scratch, it doesn’t automatically save until you press the save button.” – Kerensa L. (Source Capterra)

- “Limited integrations. No mobile apps. Outdated UI” – Mohammad E. (Source Capterra)

- “The document templates can be difficult to tailor to your own requirements.” – Sharon P. (Source Capterra)

- “I find the user interface difficult to use. This really creates a problem when you want to apply for funds and credits. I would love it if we can customize the document templates of our choice. Please introduce an auto-save option.” – Tansi P. (Source G2)

- “The most frustrating thing about this software is that most of the large business companies cannot use this software because it doesn’t have the capability of storing and traversing large banking transactions. Another issue about this software is that its storage memory is limited.” – Jennifer A (Source G2)

What are Clear Books’ Ratings from Other Review Sites?

(As of January 2024)

- Capterra: 4.6/5

- G2: 4.8/5

- GetApp: 4.6/5

- Trustpilot: 4.3/5

- Software Advice: 4.5/5

What’s My Final Verdict on Clear Books?

Clear Books offers a comprehensive range of features that can help businesses streamline their payroll and HR processes. From auto-enrolment to end-to-end CIS support, I believe the software sufficiently covers major payroll needs.

With Clear Books, users can easily input and manage employee information, pay rates, and other necessary details while the system takes care of tax calculations and generates detailed tax and accounting reports. Along with a financial tracking feature, the software also offers customised invoicing, payment reminders, and integration with administrative and accounting functions. I like that the software offers all these features in a user-friendly interface, and also has a bank-import tool for automated reconciliation that I find quite impressive.

But to keep this Clear Books review truly honest, I must also say that the software lacks the level of automation required to put a significant dent on the time spent on repetitive tasks, which could be fixed by offering more web API integrations. Plus, I think the lack of an auto-save function and the inability to customize document templates according to company requirements are some of the features that Clear Books could improve upon.

To conclude, I believe Clear Books is a solid payroll and HR solution with an impressive suite of features. There are some areas for improvement and a need for more automations, but it’s still quite good as it is.