Mobile App: Setting up overtime rates

Set up overtime calculations and oversee overtime pay on timesheets

Overtime pay is crucial for organizations with employees who work beyond regular hours. Jibble’s employee overtime tracker simplifies managing these rates, ensuring compliance and fair compensation.

Here’s why it’s important:

- Labor Regulations: For example, the Fair Labor Standards Act (FLSA) mandates “time-and-a-half” (1.5x) pay for exceeding 40 hours a week.

- Regional Variations: Different regions might have specific overtime calculation factors or multipliers you need to adhere to.

Jibble allows you to set up overtime rates to match your region’s regulations and guarantee your employees receive the correct compensation for their extra hours.

This article covers:

- Setting up Overtime Rates

- Viewing Overtime Pay in Exports

- Billable Amounts and Overtime Calculations

Setting up Overtime Rates

Important❗️: Ensure that you have specified a billable rate for each of your team members on their profile details before creating overtime rates. Find out more about updating a person’s profile information.

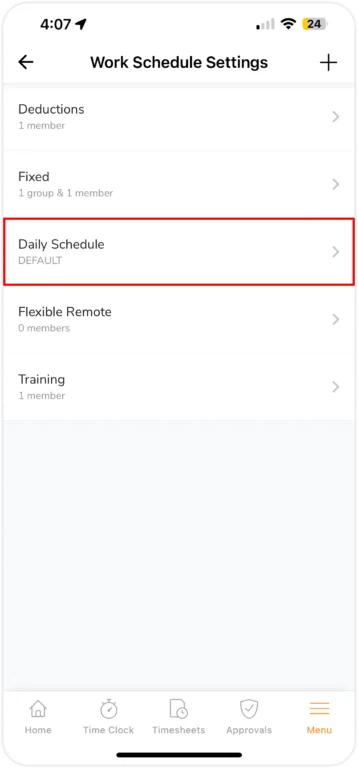

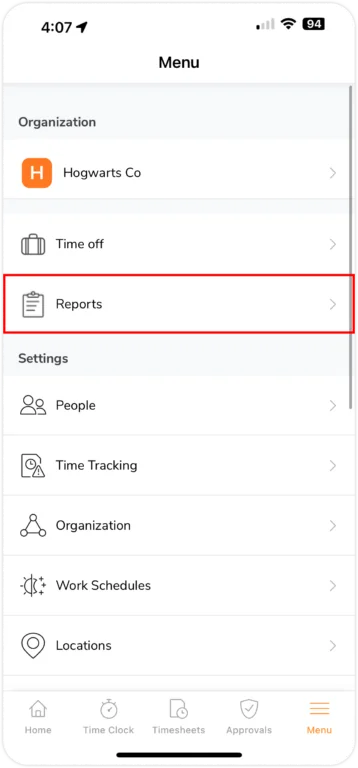

- Go to Menu > Work Schedules.

- You might need to create a work schedule if you have not created one. If you have created one, select the work schedule you want to apply overtime rates to.

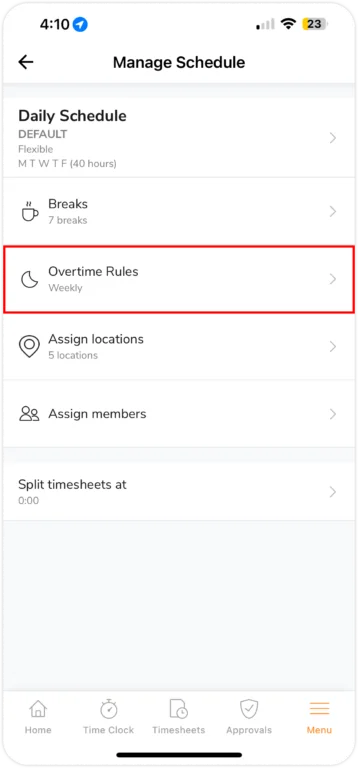

- Tap on Overtime Rules.

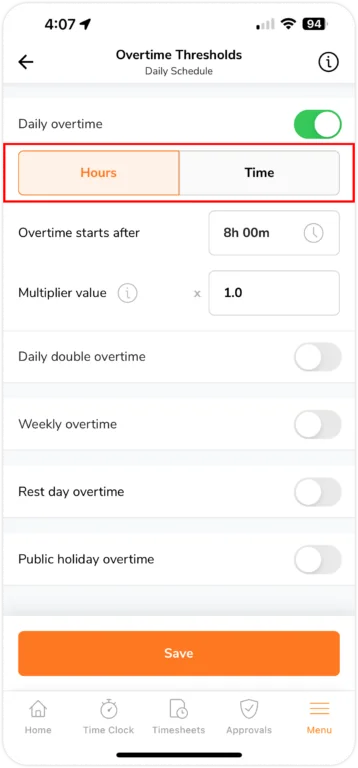

- Select the type of overtime(s) that complies with the regulations set by your company. See our article on how overtime works for further information on overtime regulations.

- Define the overtime thresholds, whether they are based on a specific time or a certain number of hours worked.

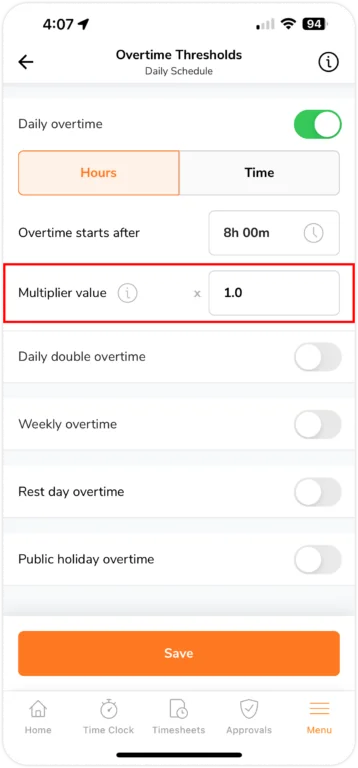

- Input the multiplier value. This value will be used to calculate overtime pay and will be applied to hours worked beyond the set threshold.

- Tap on the Save button.

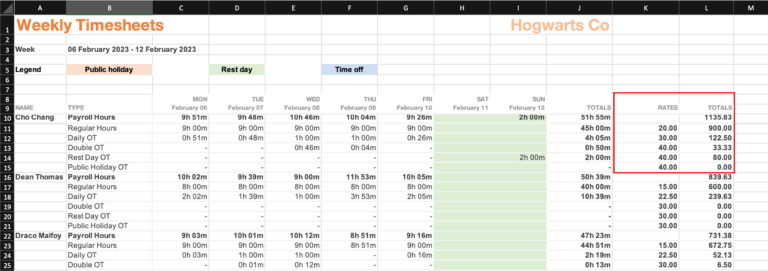

Viewing Overtime Pay in Exports

The total Billable Amount displayed in timesheet exports will be based on the overtime multiplier rates.

Timesheet summary reports provide a comprehensive view of total overtime hours, their associated rates, and the total billable amounts for each team member.

- Go to Menu > Reports.

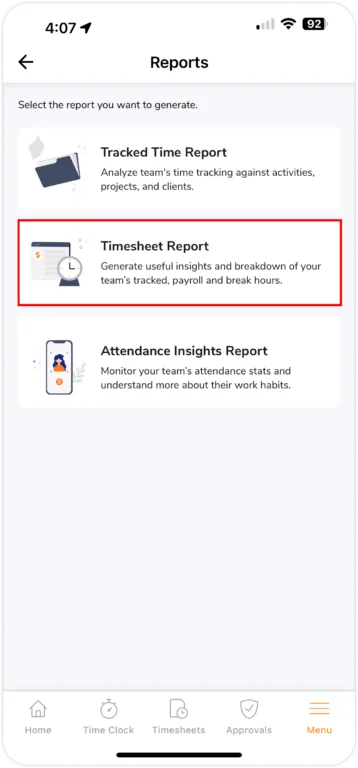

- Tap on Timesheet Report.

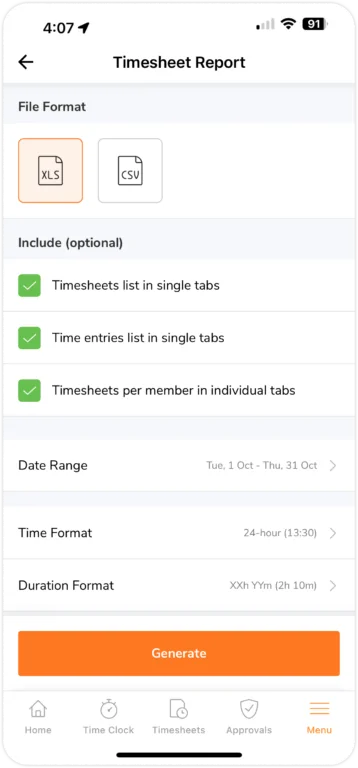

- Select a file format. This could be either CSV or XLS format.

- Tap on the checkboxes for additional files to export. For more information, check out our article on the different types of reports that can be exported.

- Select the desired date range, time format, duration format, and filters.

- Tap the Generate button.

- Once a report has been generated, a push notification will appear. Tap the push notification to open the generated report.

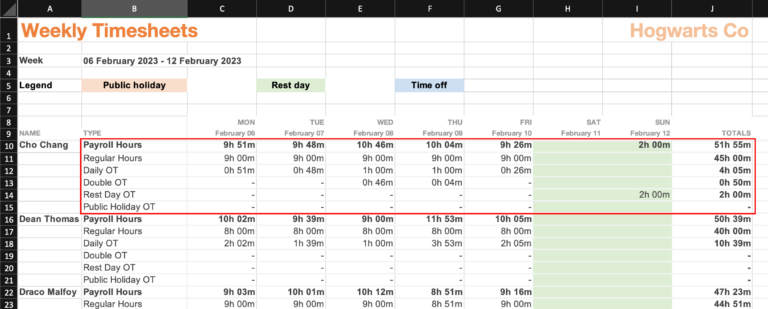

- In the exported file, you will find a breakdown of payroll hours, categorized into regular hours and overtime hours.

- Each row will display the respective hours corresponding to the type of overtime.

- The rates for each kind of overtime and the total billable amounts are shown in the last two columns.

Billable Amounts and Overtime Calculations

Overtime pay formulas:

| Formula | |

| Overtime Rate | Multiplier Value * Billable Rate |

| Billable Amount | (Billable Rate * Regular Hours) + (Billable Rate * Paid Time Off Hours)+(Daily OT Rate * Daily OT Hours)+ (Daily Double OT Rate * Daily Double OT Hours)+(Public Holiday OT Rate * Public Holiday OT Hours)+(Rest Day OT Rate * Rest Day OT Hours) |

Example 1

Let’s take a look at Sarah, an employee at a firm that enforces an 8-hour workday. According to the firm’s policy, working more than 8 hours in a single workday is considered as daily overtime, while working more than 12 hours is considered as daily double overtime.

On Monday, Sarah clocks in at 8 am and clocks out at 10 pm. This is how her overtime compensation is calculated:

- Total payroll hours: 14 hours

- Regular hours: 8 hours

- Daily Overtime Hours: 4 hours

- Daily Double Overtime Hours: 2 hours

- Billable Rate: $20/hour

- Multiplier Value

- 1.5x for Daily Overtime

- 2x for Daily Double Overtime

Overtime rate calculations:

- Formula: Multiplier Value * Billable Rate

- Daily OT Rate: 1.5 * $20 = $30

- Daily Double OT Rate: 2 * $20 = $40

Overtime pay calculations:

- Regular Hours: 8 hours * $20 = $160

- Overtime Pay

- Daily OT: 4 hours * 30 = $120

- Daily Double OT: 2 hours * $40 = $80

Billable Amount: $160 + $120 + $80 = $360

With overtime included, Sarah’s total billable amount for the day is $360.

Example 2

Let’s now discuss Frank. Frank works on a Sunday, which happens to be a public holiday (and a rest day). His overtime compensation is calculated as follows:

- Payroll Hours: 8 hours

- Regular Hours: 0 hours (working on a public holiday is regarded as Public Holiday OT)

Note: For a more detailed explanation of Malaysia-specific overtime calculations, visit our articles on how overtime works or how overtime is calculated according to the Malaysian Employment Act - Public Holiday Overtime Hours: 8 hours

- Rest Day Overtime Hours: 0 hours (when a Public Holiday and a Rest Day falls on the same day, Public Holidays are given priority)

- Billable Rate: $20/hour

- Multiplier Value

- 1.5x for Public Holiday

- 2x for Rest Day Overtime

Overtime rate calculations:

- Formula: Multiplier Value * Billable Rate

- Public Holiday OT Rate: 1.5 * $20 = $30

- Rest Day OT Rate: 2 * $20 = $40

Overtime pay calculations:

- Regular Hours: 0 hours * $20 = $0

- Overtime Pay

- Public Holiday OT: 8 hours * 30 = $240

- Rest Day OT: 0 hours * $40 = $0

Billable Amount: $0 + $240 + $0 = $240

In this example, for the 8 hours Frank worked on the public holiday, his total billable amount is $240.