Mobile App: Calculating breaks and automatic deductions

Learn to include breaks and use automated deductions for precise payroll

Jibble’s timesheet software simplifies payroll calculations by accurately tracking the duration of employee breaks and supporting automatic deductions of break times from the total work hours. This process ensures that the final payroll hours for each employee reflect only the actual work time, for precise and reliable payroll calculations.

This article covers:

- Setting up breaks and automatic deductions

- Understanding the calculation for breaks and automatic deductions

Setting up breaks and automatic deductions

After setting up your work schedule and working hours, you can proceed to configure breaks and automatic deductions.

Important ❗: Automatic deductions can only be set up and managed via Jibble’s web app. Read more on calculating breaks and automatic deductions on web.

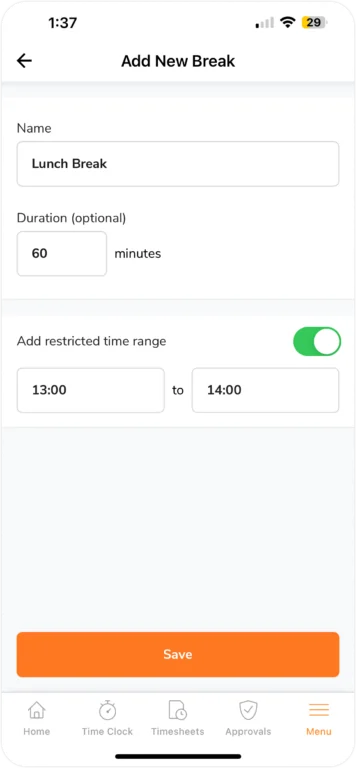

You’ll be able to specify the type of break, whether it’s unpaid or paid together with specified time frames and durations. For more information, check out our article on managing work schedules and tracking break time.

Understanding the calculation for breaks and automatic deductions

Break time and automated deductions are readily accessible on an individual’s timesheet.

- Select Timesheets.

- Select either Daily or Monthly Timesheets.

- Select a member and click on the specific hours or day you wish to view.

- A breakdown of their timesheets will be visible.

- Break entries will be shown with an orange indicator.

- To view automatic deductions, expand the Payroll Hours tab.

- Under the Tracked Hours section, you’ll see the total break hours and total automatic deductions.

▶️ Follow along to see how it’s done:

Example Calculations:

This scenario explains how Cedric’s work schedule settings in Jibble affect his timesheet:

Cedric’s Work Schedule:

- Lunch Break: 60 minutes (paid)

- Automatic Deduction: 1 hour after working 8 hours

- Daily Overtime: Starts after 8 hours worked

Monday’s Tracked Hours:

- Total Tracked: 11 hours (includes breaks)

- Breakdown:

- Worked Hours: 10 hours (excluding breaks)

- Lunch Break: 1 hour (paid)

- Automatic Deduction: -1 hour (applied after 8 hours worked)

As Cedric has tracked more than 8 hours on Monday, 1 hour is automatically deducted based on the predefined automatic deductions set on his work schedule.

Payroll Hours:

Jibble calculates payroll hours by considering worked hours, paid breaks, and automatic deductions. Here’s Cedric’s breakdown:

- Total Payroll Hours: 10 hours

- Breakdown:

- Regular Hours: 8 hours

- Daily Overtime Hours: 2 hours (since he worked more than 8 hours)

Explanation:

- Cedric’s 1 hour lunch break is considered as paid work time.

- After working 8 hours, Jibble automatically deducts 1 hour according to his work schedule.

- The remaining 10 hours (worked hours including paid break – automatic deduction) are divided into:

- Regular Hours: capped at 8 hours (standard work hours)

- Daily Overtime Hours: the remaining 2 hours exceeding regular hours