This Review Covers:

- Overview

- What Do Users Like About Trolley?

- What Don’t Users Like About Trolley?

- What Pricing Plans Does Trolley Offer?

- What are the Standout Features of Trolley?

- Positive User Highlights

- Negative User Highlights

- What are Trolley’s Ratings from Other Review Sites?

- What’s My Final Verdict on Trolley?

Overview

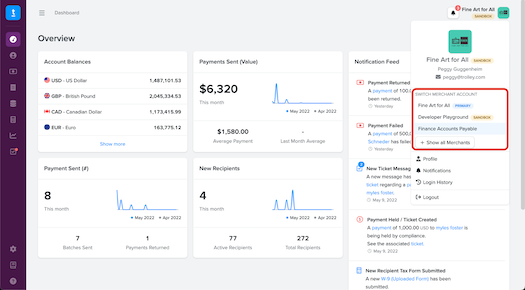

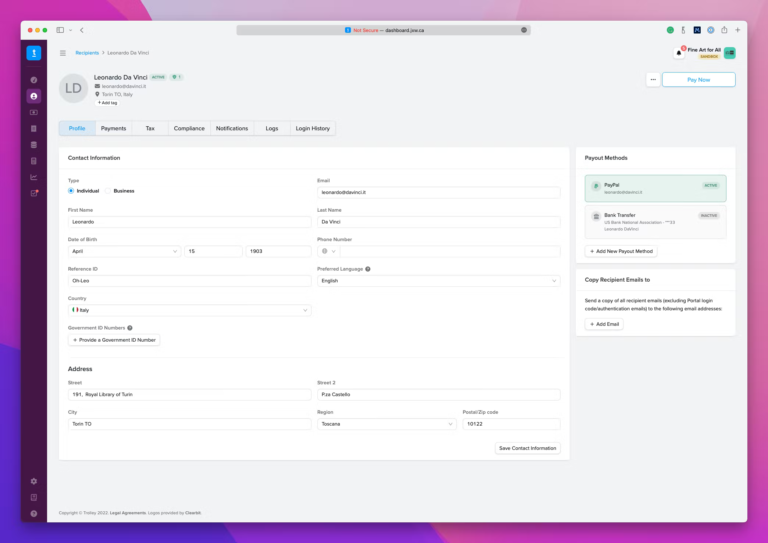

Trolley, formerly called Payment Rails, is a platform for businesses to send payments and process payroll globally.

Dubbing itself “the payroll platform for the internet economy”, the software offers payroll features such as onboarding, compliance, and year-end tax reporting. Trolley boasts of fast, efficient, and automated payouts and enables businesses to automate payment approval flows, manage returned payments effortlessly, and monitor live payments in real time with accurate foreign exchange rates.

Trolley also offers recipient and vendor management, approval process control, and cash management, and fraud detection. It has a customizable recipient widget that can be integrated into users’ websites or mobile apps and includes bank validation rules for multiple countries.

The software is quite user-friendly and even features geolocation support through a built-in time clock. It also offers expanded earning types and robust employee records.

Yet despite all of these, I must say that Trolley has downsides — nothing is ever perfect, after all. These include a longer-than-anticipated onboarding process that poses a significant learning curve for users. The inability to download monthly statements is also concerning, and the fact that the software does not allow for the saving of passwords upon logging in is unintuitive and can be quite frustrating after some time. Employee payment status is also unclear after payments are sent out, and the platform is not able to process non-USD payments in batches with USD payments.

But before we make any judgments, we should first take a look at what else the software has to offer So, without further ado, let’s dive into this Trolley review.

What Do Users Like About Trolley?

- User-friendly interface

- Built-in time clock supports geolocation

- Expanded earning types

- Employee records and employee portals

- Year-end tax reporting

What Don’t Users Like About Trolley?

- Difficult onboarding process

- Batch processing of non-USD payments with USD payments is not possible

- No option to download a monthly statement

- Password cannot be saved when logging in

- Unclear payment status

What Pricing Plans Does Trolley Offer?

Trolley offers two plans that come with base fees and transparent per-paid-recipient pricing. These plans boast of scalability, customizability, predictable cost control, and tiered discounting. Users can pick the modules they want to build the plan they need.

Trolley Standard

This plan offers in-app and SMS two-factor authentication, notifications via email, SMS, and Slack, the ability to list one IP address and one domain, invoice creation, and Zapier integrations, plus priority support and access to the Help Center. Users can choose to get the Pay, Tax, Sync, and Trust modules according to their needs, each with a different price.

The Pay module allows domestic and international bank transfers, wallets, and checks, along with white-label onboarding, fee splitting, and payment approval workflows for $49 per month.

The Tax module comes at $149 per month and allows end-to-end tax compliance in 1 jurisdiction, either the EU or the US. Recipient statement generation comes at an additional fee based on the number of recipients, starting at $2 per statement per year.

The Trust module offers identity verification, document collection (11,230+ worldwide documents), public data validation, and photo verification with document matching for $49 per month inclusive of ten scans per month, plus per-scan pricing in excess of the limit, starting at $2.50 per completed scan.

The Sync module comes at $35 per month and offers integrations with Xero or QuickBooks and NetSuite, vendor pull, invoice pull or invoice status push, and four refreshes per day.

Trolley Plus

Building on the features of the Standard plan, Trolley Plus modules have additional and more advanced features. This plan allows the listing of unlimited IP addresses and domains, has granular user roles, access to SOC2 report, API rate limit increases, recipient syncing between multiple merchants, custom SLAs, and a dedicated Customer Success Manager.

The Pay module is enhanced with a revenue stream and transaction/FX volume discounting, the Tax module comes with two jurisdictions (both the EU and the US and statement generation is included in the subscription, and the Sync module features near real-time refreshes. The Trust module has suspicious login flagging and automatic re-verification triggers coming soon as well.

Pricing for this plan can be obtained directly from Trolley representatives.

What are the Standout Features of Trolley?

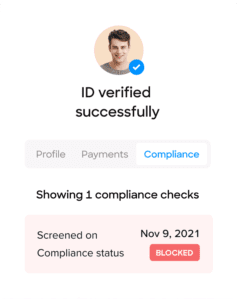

1. Risk and Fraud Mitigation

Trolley has a robust set of controls and procedures to make compliance with payment rules a breeze. It allows businesses to remain compliant with government regulations, local payment regulations, and network rules on payouts by screening recipients.

The software has a built-in Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) compliance engine that automatically screens individuals and entities using advanced AI and fuzzy matching logic to help secure businesses from undesirable individuals and to make sure that each payment is checked for legitimacy and legality. Trolley checks payee identities against all the necessary global watchlists such as the OFAC, EU, OSFI, and HMT.

Trolley also has bank-level security and encryption to ensure that businesses are protected against data security threats. They have customizable security management settings to ensure that all unique security needs are met.

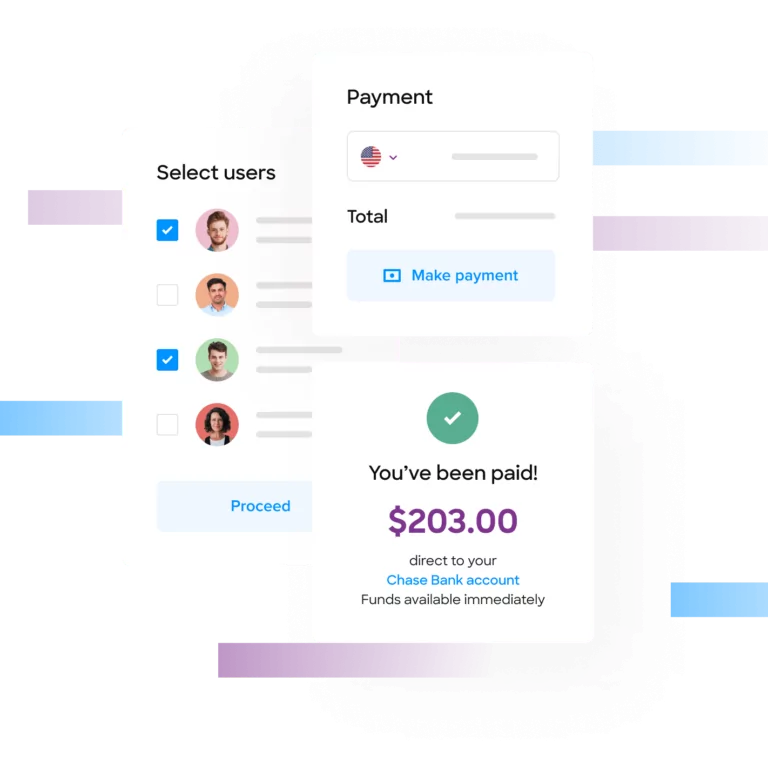

2. Payout Automation Management

Trolley offers automated payment processing features that allow businesses to manage mass payouts to suppliers, simplifying the process of sending payouts to their sellers, freelancers, and service providers all over the globe.

The software allows businesses to monitor payouts in real-time, keeping them updated with the current live status of any payment so they know exactly where any payment is at any given time. The direct access to live payment statuses enables them to handle payout support queries better, resulting in an improved experience for everyone. They can also automate payout approvals & workflows by assigning approval rights to individuals based on custom value limits. Emails are automatically sent to approvers when a payment is awaiting their approval, providing optimal transparency and traceability on who approves or declines each and every payment.

Trolley also allows businesses to make instant payments to end-users for when they are needed pronto, and directly into their existing debit cards. Plus, businesses also get access to live FX rates based on the live interbank rate, and they can convert into more than 150 currencies, so payouts can be sent wherever, and in whichever currency end users prefer.

3. Tax Compliance

One of the most crucial aspects of running a business is ensuring compliance with taxes and tax-related legislation. Doing otherwise would result in expensive fines and legal trouble that could be avoided by complying with what the law dictates. Fortunately, Trolley allows businesses to comply with EU and US tax authorities by streamlining supplier tax onboarding and filing according to DAC7 regulations, and in line with forms 1099/1042-S.

Trolley makes tax compliance easier with automated information collection and validation during onboarding. It also calculates withholdings, automatically associates payouts to per-recipient tax records, and simplifies year-end tax reporting so those burdens are lifted off of the shoulders of staff, saving nearly 80% of time spent on administrative tasks.

Using either the white-label portal or the embedded widget, businesses are guaranteed a secure collection of payee identification and tax information. They can collect and complete tax forms following IRS & DAC7 requirements digitally and rest assured that the data is stored and encrypted securely. They also won’t need to redo and update withholdings manually, as those are automatically updated according to changes in tax regulations. It also supports multiple income types such as services, rent, royalties, and more. It can also split and allocate single payments to multiple income types, making the process as easy as possible so efforts and resources can be saved and spent where they truly matter.

![]()

4. Reporting

Aside from facilitating payments, Trolley also keeps track of all data entered into the system and generates actionable insights from those for better-informed business decisions.

The software’s reporting feature allows businesses to track financial performance and monitor transactions. It gives visibility into transaction history, payment analytics, financial reporting, compliance reporting, and custom reporting. These features provide valuable insights into payment trends, financial performance, and regulatory compliance.

Selected Positive User Feedback:

- “Ease of use for our customers to log their direct deposit information through the PR plugin, CSV upload for payout to customers (no more manual logging of individual’s payout), and (now most recently) customer access to view payment history.” – Jordan S. (Source Capterra)

- “Payment rails makes payments easy with a robust API that works across borders. They also handle tax compliance and have a knowledgable team that’s always ready to help.” – Verified Reviewer (Source Capterra)

- “Once set up, it was easy to use. Dashboard/interface is great and user friendly.” – Jonah C. (Source Capterra)

- “What we liked the most is the ease of use of their APIs and especially their widgets which are super easy to integrate with and set up.” – Luis S. (Source Capterra)

- “Ease to enter information for a payee, easy to track all your payments, export functions, allowing multiple users (auditor, collaborators), the two-person process for payouts, easy process to pull money into the platform.” – Verified Reviewer (Source Capterra)

- “Payment Rails has a UI which is very easy to use if you are doing manual payments within the Payment Rails platform, but they also have a fantastic API which we were able to integrate into our proprietary platform so we can make payments without our existing workflow.” – Jeremy C. (Source Capterra)

- “The Payment Rails dashboard is best-in-class. We’ve used a number of third-party payments platforms and as something we spend a lot of time using it’s important for it to be modern, usable, and fast.” – Locke B. (Source Capterra)

- “Payment Rails enables our two-sided marketplace to pay freelancers in nearly every country in the world in just a few days with their local currency. It handles FX and all the headaches involved with taxes.” – Sam W. (Source G2)

- “The convenience of paying out users on a daily to weekly basis, generating of US Tax forms for independent contractors.” – Jordan S. (Source G2)

- “Payment Rails has streamlined our process with easy importing and exporting of payable amounts and one-click payments. The email templates are attractive and professional-looking. The dashboard gives us transparency and all the details readily available through an easy interface.” – Valeria S. (Source G2)

- “My artists can receive their tax forms thru their account, and receive payment by bank transfer and paypal.” – Tanvi P. (Source G2

- “Easy pay, transaction report, balance report showing the change in balance.” – Iva F. (Source G2)

- “Centralized platform, full visibility on all that is happening, intuitive, different balances.” – Alexandra S. (Source G2)

Selected Negative User Feedback:

- “The only one worth calling out is the onboarding process takes more time than expected.” – Sam W. (Source G2)

- “The code for login into the portal sometimes never arrives. It often happens with certain recipients that can’t log in or say the code takes ages to arrive.” – Alexandra S. (Source G2)

- “Does not allow payments to be sent internationally in USD.” – Byran H. (Source G2)

- “Unable to batch non-USD payments with USD payments – would make it easier to send one whole batch.” – Verified User (Source G2)

- “The set-up process for bank transfers was a little more difficult than desired but this is due to legal regulations and requirements.” – Spencer M. (Source G2)

- “Bulk importing of tens of thousands of recipients was slightly tedious. We had to break our list up into groups of around 1000 recipients each to avoid issues.” – Locke B. (Source Capterra)

- “The backend interface could use some improvements; it can sometimes be difficult to find the information you look for.” – Verified User (Source Capterra)

- “Errors during payouts creation (seldom but still) – hard to get what was going wrong during payout creation – timeout errors.” – Oleg P. (Source Capterra)

- “It’s hard to learn how to use. If you did not have someone teaching you how to use it, it would be incredibly difficult to figure out.” – Jennifer H. (Source Capterra)

- “Trying to track down a payment that went to a closed bank account for a client. Took a couple of weeks to resolve.” – Beth W. (Source Capterra)

- “Some sections have some small bugs but these are fixed within 24-48 hours of reporting them to the PR team.” – Nathan S. (Source Capterra)

- “Unsure about payment status beyond sending it out. Too many angry workers not sure where their money is and not being able to know why it isn’t in their account if there was an issue.” – Sebastian J. (Source G2)

- “There is not currently a way to download a monthly statement. I have to go to 3 or 4 different screens to view all of our transactions.” – Ryan W. (Source Capterra)

- “It does take a little bit to get set up and approved for bank transfer payouts but they’ve really tried to simplify the process as much as possible and are lightyears ahead of anyone else.” – Spencer M. (Source Capterra)

- “It does not have the option to save my password when I log in.” – Heather H. (Source Capterra)

What are Trolley’s Ratings from Other Reviews

(As of January 2024)

- Capterra: 4.6/5

- G2: 4.7/5

- GetApp: 4.7/5

- Software Advice: 4.5/5

- TrustRadius: 9.2/10

What’s My Final Verdict on Trolley?

Trolley, formerly called Payment Rails, streamlines payroll operations and provides un precedent transparency with features like fraud detection, cash management, live payment tracking, and real-time foreign exchange rates. The cloud-based solution offers important features like automated payment flows, filing of year-end taxes, and onboarding of new employees. Businesses can also handle returned payments, monitor transactions through financial reporting, and ensure compliance with global payment regulations. Along with a customizable receipt widget and a user-friendly interface, Trolley also offers a time clock with in-built geolocation functionality.

While it has quite a lot of advantages, I must also talk about its downsides, as I promised an honest Trolley review. The software’s onboarding process takes longer than usual and presents a steep learning curve for new users. Once sent out, there is no way to clearly track payments which leads to confusion and frustration during the payroll process. Additionally, the software is not able to process non-USD payments in batches with USD payments and has no option to download monthly statements. Furthermore, users are unable to save their passwords while logging in.

Now, I’d say that the good stuff nicely balances out the bad, and in an internet economy like ours, it’s always best to have a reliable payout platform that can handle everything you need. Trolley is the platform of choice for many social media influencers, artists, freelancers, ad networkers and publishers, content creators, P2P market sellers, video game and esports content creators, and more. But is Trolley is truly right for you? If you feel like it is, avail their 30-day free trial to be sure before committing to a subscription.