Xero, the popular cloud-based accounting software, has revolutionized the way businesses manage their finances. With its user-friendly interface and powerful features, it has become a go-to solution for many organizations. However, what makes Xero truly extraordinary is its ability to integrate seamlessly with other business tools, expanding its functionality and efficiency.

In this article, I will explore some of the best free Xero integrations available in the market, unlocking a new world of efficiency and automation for business owners and accounting professionals alike. Whether you are seeking to automate invoicing, streamline expense management, or optimize inventory control, these integrations offer a wealth of possibilities to elevate your financial management processes, all without breaking the bank.

Top 6 Free Xero Integrations

The Definitive List

1. Jibble

Jibble is a user-friendly app designed for seamless time and attendance management for teams. With Jibble, employees can easily clock in and out using any device.

Managers have direct access to all data online or from their mobile phones, ensuring they are always up to date with their team’s attendance. They can view, manage, and download payroll-ready timesheets for efficient payroll and project calculations

Jibble also eliminates the issue of buddy punching by using mobile devices to enforce GPS location sharing and facial recognition verification, allowing managers to know who clocked in from which location.

Jibble goes beyond just basic time tracking, offering powerful insights and reporting features that allow employers to manage payroll, employee productivity, and budget costs more effectively. The app provides detailed reporting and analytics, giving users a better understanding of their payroll, punctuality, and attendance.

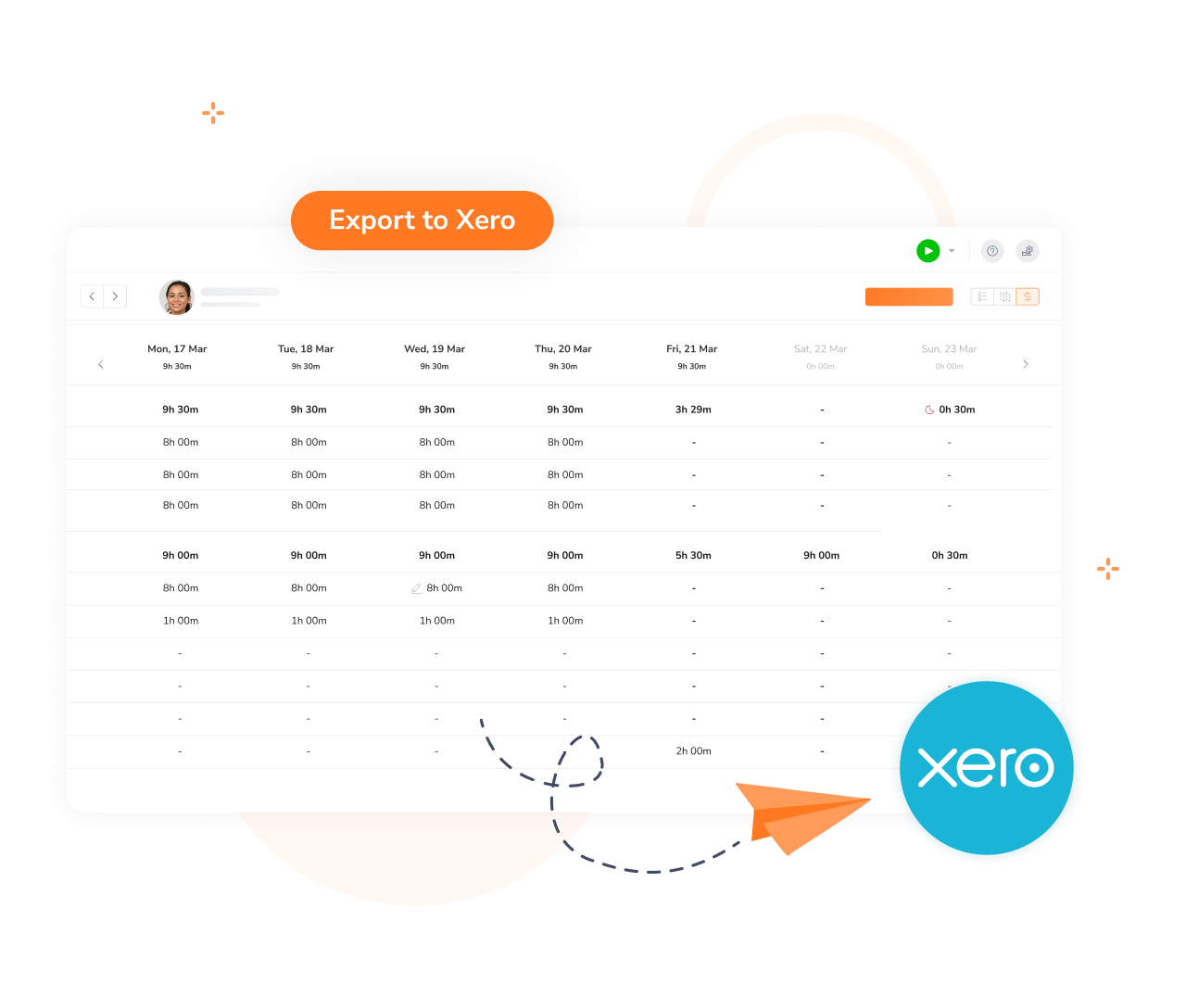

The integration of Xero and Jibble allows for seamless time tracking and invoicing. By automating worked hours and timesheets with Jibble, users can easily create and send invoices directly to Xero. This integration is highly convenient and efficient for businesses looking to streamline their invoicing processes.

To connect Jibble with Xero, users must have Administrator permissions. This ensures that only authorized individuals have access to view and make changes to Integration Settings. Once logged into Jibble, users can navigate to the Integrations tab and select Xero from the list of available integrations. They will then be redirected to Xero to authorize Jibble’s access to their Xero account.

Once connected, Jibble and Xero sync information such as payroll hours and invoice lines. This allows users to automatically generate invoices in Xero using the payroll hours recorded in Jibble. Additionally, users can export payroll hours from specific members and date ranges. Overall, the integration of Xero and Jibble provides a seamless and efficient solution for time tracking and invoicing needs.

Key Features

- Punch in and out with mobile or desktop

- Turn any device into a time clock app

- Face recognition via mobile or kiosk

- Timesheet derived from tracked time

- Can be used offline

What Users Like

- Fosters honesty and transparency within the team

- User-friendly and easy to navigate

- Dashboard shows real-time attendance data

- Generates reports for payroll use

- Eliminates the need for manual entries

What Users Don’t Like

- Some users just don’t like orange!

Learn how to integrate Xero with Jibble.

2. Mailchimp

Mailchimp is a marketing automation platform that helps businesses create and analyze effective email and ad campaigns. With complete transparency and detailed tracking, users can easily monitor the success and click-through rates of their campaigns. The software also provides the ability to manage subscribers and un-subscribers, offering a comprehensive solution for managing email lists.

One of the standout features of Mailchimp is its free option, which allows users to send up to 1,000 emails to 500 subscribers each month without any financial commitment. This makes it an accessible option for small to medium-sized businesses. Additionally, the software’s mobile application provides users with the convenience of being able to create and send campaigns, manage subscribers, and monitor account activity on the go.

When you integrate Mailchimp with Xero, you’ll eliminate the need for manual data entry, spreadsheet management, and constant configuration of email lists. Additionally, the app ensures that contacts in Mailchimp are always up to date by automatically reflecting any changes made in Xero.

Setting up the integration is simple, and it requires a Xero premium subscription and a Mailchimp subscription. Upgrading to the premium plan in Xero enables users to fully utilize the Mailchimp app.

While Mailchimp is a popular email marketing software, it may not be the ideal choice for small businesses and solopreneurs. Its free plan does not offer as many features as some competitors. Furthermore, setting up automated email campaigns isn’t all that simple. The user interface can be confusing, making it challenging to locate specific functions. There’s definitely a learning curve, and if you’re not familiar with the software, you’ll need some time to learn it completely.

Key Features

- Multiple options for email design

- Option to code emails from scratch

- Commenting section for collaboration and error-free emails

- Advanced A/B testing functionality

- Automated workflows

What Users Like

- Cost-effective and easy to implement

- Drag-and-drop elements for professional newsletters

- Useful analytics tools for campaign effectiveness

- Pre-designed templates for quick email creation

- Improves lead generation process

What Users Don’t Like

- User interface can be confusing

- Navigation needs to be smoother

- Complicated features

3. PayPal

PayPal is a well-known and widely used online payment service that has also made a name for itself in mobile payment apps. In fact, PayPal’s mobile app is very similar to its subsidiary, Venmo. While Apple Pay and Google Pay dominate point-of-sale transactions, PayPal’s mobile app allows users to easily make payments and request payments from friends, pay websites, and even some stores.

One of the strengths of the current PayPal app is its simplicity and straightforwardness, making it an attractive option for users who prefer a more no-nonsense approach compared to Venmo. Additionally, PayPal benefits from its widespread acceptance as a payment option on various websites and apps, as well as its large user base that spans over 200 countries.

One of the key advantages of integrating PayPal with Xero is the ability to accept payments from anywhere in the world, in any currency. PayPal is a globally recognized and trusted payment option, giving businesses and their customers the confidence to transact securely.

The integration between PayPal and Xero ensures instant synchronization of payments, expenses, refunds, and deposits. This eliminates the risk of errors and guarantees accurate allocation and recording of processing fees and sales taxes.

One thing I don’t like about PayPal is that it has various fees that may not be immediately clear to customers. For example, they have chargeback fees and do not refund the transaction fee when customers return their purchases. This can be a hassle for businesses that frequently process returns, as these fees can accumulate and impact their profitability.

Another thing is that PayPal charges an additional fee of 1.50% to process international credit cards, while competitors such as Square and Stax do not charge this fee. Additionally, Square offers cheaper card readers, with the first one being free and each additional one costing only $10.

Key Features

- Allows sellers to send invoices

- Two-factor authorization for security

- Integrations with accounting software, e-commerce software, and more

- Enables instant payments

- Works with multiple currencies

What Users Like

- Easy to set up, send, and receive money

- Provides an alternative solution for credit card payments

- Integration with multiple payment sites for a seamless experience

- Trusted reputation as a long-standing payment system

- Safe and secure

What Users Don’t Like

- Transactions may include a $20 chargeback fee

- No transaction fee refunds when customers return purchases

- Additional fee of 1.50% for processing international credit cards

4. PandaDoc

PandaDoc is a cloud-based document management software designed to help businesses improve their document creation process. The software offers customizable templates and a content library, allowing users to create and store proposals in one place. With features like e-signature capabilities and real-time alerts, PandaDoc enables users to track the progress of their documents and engage with clients more efficiently.

Additionally, PandaDoc offers integrations with popular third-party applications. With its user-friendly interface and robust features, PandaDoc is a valuable tool for businesses aiming to optimize their sales and marketing tasks, as well as improve the efficiency of their HR departments.

Xero and PandaDoc can work together to further improve a business’s processes. With Xero’s accounting tools, businesses can manage their finances, invoicing, and expenses. PandaDoc complements Xero by providing a comprehensive document management solution.

Once the documents are created in PandaDoc, they can be linked to relevant transactions in Xero. This integration allows for better organization and visibility into the financial aspects of the business, as well as ensuring that the documents are accurately associated with the appropriate financial records.

One major drawback of PandaDoc is its pricing structure. Its paid tiers can be too expensive for smaller businesses or solopreneurs, with the Essentials plan starting at $35 USD per user per month when billed monthly. HelloSign, a competitor, offers more affordable solutions. To justify the cost of using PandaDoc, you’d need to make full use of the features included in its paid plans.

Additionally, some users have experienced technical glitches as well as some compatibility issues on mobile devices. Another downside is the difficulty in changing the signer in case you’ve made a mistake, as there is no straightforward solution currently available. This inconvenience forces users to delete and recreate documents in cases of typos or errors, which can be a hassle.

Key Features

- Simplifies document management processes

- Integration with various applications

- Easily editable and shareable contract and proposal templates

- Remote signing capabilities for clients

- Custom form creation

What Users Like

- Streamlines document approvals and saves time

- User-friendly interface and easy editing capabilities

- More user-friendly than competitors like DocuSign

- Convenient document-sharing capabilities

- Drag-and-drop features

What Users Don’t Like

- Too expensive for smaller businesses or individuals

- Some integrations require a subscription to premium plans

- Occasional technical glitches on mobile

5. WooCommerce

WooCommerce is an ideal solution for both small and large-scale online vendors. As an open-source eCommerce plugin for WordPress, it offers a basic online store setup for free. Users have the flexibility to sell a wide range of items, from physical products to digital files and services.

They can enhance their store’s functionality by developing their own plugins or purchasing pre-made ones from the WooCommerce store. One of the standout features of WooCommerce is its automated shipping cost and sales tax calculation, which applies to worldwide locations.

Additionally, users can easily manage their store from anywhere using the user-friendly store management interface, making inventory updates and product management hassle-free.

Integrating Xero and WooCommerce offers several benefits for businesses. One major advantage is the automatic synchronization of orders and invoices between the two platforms. When an order is placed on the website, it is instantly copied to Xero as an approved invoice, including all relevant details such as customer information, product details, shipping costs, and tax codes.

Another significant benefit of integrating Xero and WooCommerce is the synchronization of inventory data. As orders are completed online, the inventory in Xero is automatically updated. This ensures that stock levels are always accurate and up-to-date, preventing overstocking or shortages.

Despite its initial appeal, WooCommerce has some drawbacks that can impact the overall user experience. One major downside is the need to purchase add-ons, such as the ability to enable subscriptions, which can significantly increase the cost of the license. Additionally, setting up and managing a WooCommerce store can be challenging for users with limited technical knowledge, as it involves a learning curve.

Another issue with WooCommerce is its performance. Users have reported the software can be a bit sluggish, often experiencing delays when performing searches or other tasks. Although server speed can contribute to this issue, the platform itself can feel unresponsive at times.

Key Features

- Analytics and reports on site performance, total sales, and more

- Ability to track orders sold at full price and at a discount

- Multiple payment processing options

- Integration with various applications

- Customer reviews for products

What Users Like

- Seamless integration with WordPress and other apps

- Easy and intuitive interface

- Makes setting up an e-commerce website quick and easy

- Free and premium extensions

- Highly customizable

What Users Don’t Like

- Expensive add-ons

- Can be difficult to learn to use

- Works slowly at times

6. Avaza

Avaza is a comprehensive business management solution designed for professional services companies. With features such as project management, resource scheduling, online timesheets, expense management, online invoicing, and quotes and invoices, Avaza offers a complete suite of functionality for running and managing a business.

Users can easily track projects, manage tasks, and collaborate with clients through online project collaboration. The app also provides powerful reporting capabilities, allowing businesses to gain valuable insights into their financial transactions, estimates, and expenses by customer.

The integration between Xero and Avaza offers a powerful and instant two-way sync, allowing for seamless workflow management. When it comes to invoices, the integration supports the creation of new invoices in Xero when they are created in Avaza. Additionally, any updates made to invoices in Avaza will be automatically reflected in the linked invoices in Xero.

Similarly, the integration supports the creation of new bills in Xero when they are created in Avaza, as well as the updating of linked bills in Xero when changes are made in Avaza. Payments applied to Avaza bills are also seamlessly transferred to Xero, ensuring consistency between the two platforms

One of the main I didn’t like about Avaza is the difficulty of setting it up initially. This can be a time-consuming process that requires a lot of effort and technical knowledge. Additionally, a good internet connection is necessary for the system to work properly. This can be a disadvantage for users in areas with poor internet infrastructure or for those who frequently work in locations with unreliable internet access.

Another drawback of Avaza is its complexity. With numerous functions and tools, the software can be overwhelming for some users, especially those who are not tech-savvy. The learning curve for mastering each tool can be steep, and it may take time for users to become proficient in their specific area and job position.

Key Features

- Central dashboard overview for each project

- Easily adjustable project settings

- Timesheet creation and approval

- Expense tracking

- Creation of invoices with time and expense details

What Users Like

- Expense management and bill tracking

- Time tracking feature

- Financial and project progress reports

- File storage with unlimited capacity

- Customizable price rates, team member roles, project rates, and invoices

What Users Don’t Like

- Difficult initial setup

- Needs a good internet connection to be able to work

- Limited integrations with other platforms