QuickBooks, a leading accounting software developed by Intuit, has revolutionized the way businesses manage their finances. With its user-friendly interface and comprehensive features, QuickBooks allows businesses to streamline their financial operations, monitor expenses, and generate accurate financial reports.

However, one of the key factors that sets QuickBooks apart is its robust integration capabilities. By seamlessly connecting with various third-party apps and platforms, free QuickBooks integrations empower businesses to bridge the gaps between different systems and enhance their overall efficiency.

Below, we’ll be looking at the 6 best free QuickBooks integrations that can help you improve your business processes without extra expenditures. The integrations available for QuickBooks cover a wide range of functionalities, catering to the diverse needs of businesses across industries.

Many of these third-party apps are only available through premium subscriptions, but there are those that offer free plans with generous features. With the ability to integrate with multiple apps, businesses can create a customized ecosystem of tools that work seamlessly with QuickBooks, tailored to their specific requirements.

The definitive list:

- Accurate timesheets

- Easy work hours calculation

- GPS tracking and GPS fencing

- Facial recognition and PIN codes

- Employee productivity monitoring

- Efficient task tracking

- Comprehensive reporting feature

- User-friendly and easy to navigate

- Convenient one-stop shop for managers

- Integrations with various QuickBooks, Slack, and other apps

- Mobile app sometimes crashes

Jibble is a powerful attendance app that provides real-time data for accurate attendance tracking. With features like employee productivity monitoring, timesheet creation, and location capture, Jibble ensures improved productivity and transparency. Jibble is a complete time and attendance solution for businesses of all sizes.

Jibble is undoubtedly one of the best QuickBooks integrations available in the market today. This powerful tool enables businesses to automate and streamline their operations seamlessly, providing them with numerous benefits and enhancing efficiency in their day-to-day activities.

One of the key advantages of using Jibble as a free QuickBooks integration is its ability to automate the time tracking process. With Jibble’s advanced features, employees can easily clock in and out using various methods such as facial recognition and geolocation.

The integration with QuickBooks makes it effortless to sync the time tracking information with the accounting software, allowing for seamless invoicing and payroll management. This eliminates the need for manual transfer of data, saving time and reducing the possibility of errors.

Furthermore, Jibble provides valuable insights and analytics on employee productivity and project management. With its comprehensive reporting and analytics features, businesses can obtain actionable data on employee performance, project costs, and resource allocation. These insights can be seamlessly integrated into QuickBooks.

With its robust time tracking, attendance management, and analytics features, Jibble offers a comprehensive solution for businesses of all sizes. By seamlessly integrating with QuickBooks, Jibble ensures accurate and efficient data synchronization, leading to improved productivity, cost savings, and better decision-making capabilities.

- Customer reviews and Q&A

- Fulfillment by Amazon (FBA)

- Wide range of available products

- Marketplace for third-party sellers

- User-friendly interface for browsing and purchasing

- Low marketing costs

- Large active customer base

- Amazon’s reputation and brand

- Easy to use and start selling on Amazon

- No need to manage stock with Fulfillment by Amazon (FBA)

- Selling fees and commissions

- Loss of control over inventory and logistics with Amazon FBA

- Possibility of Amazon replicating and outcompeting successful products

Amazon is a prominent online retailer and web service provider that offers a wide range of products, including apparel, electronics, grocery items, toys, and more. In addition to selling its own private-label products under brand names such as AmazonBasics, the company also facilitates sales by third-party sellers, accounting for a significant portion of its revenue.

In addition, Amazon provides various support services, including home delivery, shipping, and cloud web hosting.

Integration with Amazon and QuickBooks offers several benefits for businesses, which is why it’s on our list of the best free QuickBooks integrations. Firstly, it streamlines the process of recording orders. This integration allows users to create invoices and sales receipts, automatically update inventory with each sale, and summarize orders by day, week, month, or settlement period.

Additionally, QuickBooks integration with Amazon allows businesses to use all Amazon store capabilities. This integration covers various Amazon platforms, including Seller Central, FBA, Amazon.com, Amazon Vendor Central, and international platforms like Amazon Canada, UK, EU, and Mexico. By integrating with these platforms, businesses can effectively manage their Amazon sales and operations in a centralized system, saving time and effort.

One major drawback for sellers and vendors on Amazon, however, is the loss of control over inventory and logistics when using the Fulfillment by Amazon (FBA) service. While FBA can provide benefits such as faster shipping and customer support, it also means placing trust in Amazon to handle storage, packaging, and shipping. Sellers may face challenges managing their inventory or have difficulty maintaining control over the quality of their products.

Another negative aspect of selling on Amazon is the possibility of the company replicating and outcompeting successful products. Amazon has been known to closely monitor the sales performance of products on its platform and then introduce its own similar products, often at lower prices. This creates a disadvantage for sellers and vendors who may struggle to compete with Amazon’s resources and reach.

Overall, while Amazon offers opportunities for sellers and vendors, these drawbacks should be carefully considered before choosing to sell on the platform.

- Automatic mileage tracking

- Invoicing and bill management

- SmartScan feature for receipt uploads

- Comprehensive financial reporting tools

- Automatic syncing with third-party accounting software

- Quick and easy expense reports

- Intuitive and user-friendly interface

- Saves time and prevents manual errors

- Helps keep receipts and other files organized

- Ease of uploading receipts and other files for expense tracking

- Too expensive for some

- Mistakes in scanning receipts

- Mobile app is more complicated and has fewer features

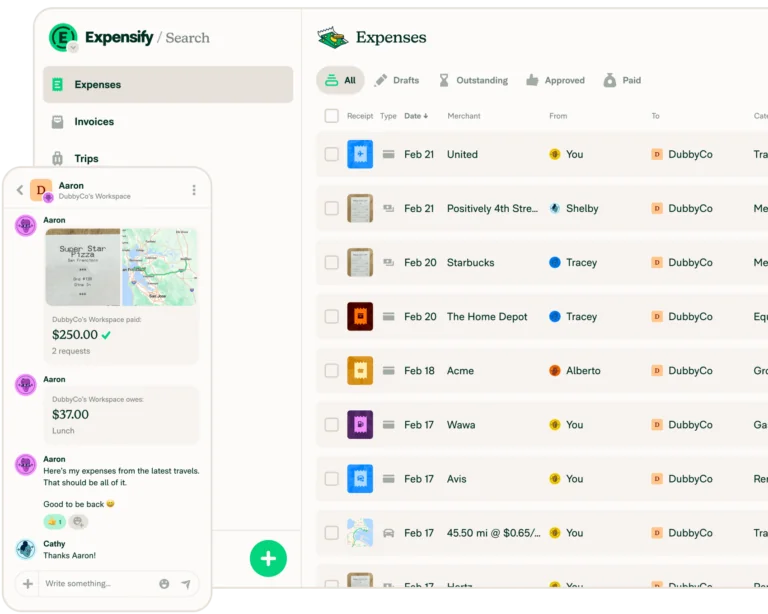

Expensify is an app that helps businesses manage their expenses efficiently. It automates the process of categorizing and coding receipts, and can even submit expenses for approval and reimbursement automatically.

One of the key benefits of using Expensify is the ability to easily track and submit receipts and expenses. This can help businesses stay organized and ensure accurate reimbursement. The app also offers next-day direct deposit reimbursement, saving time and ensuring that employees are promptly reimbursed for their expenses. In addition, Expensify provides mileage and GPS tracking, automatic credit card import, and the ability to work with receipts in any currency.

Expensify’s OCR technology is especially impressive, as it can accurately translate even the most illegible numbers on a receipt into easy-to-categorize data. In addition to receipt scanning, Expensify also includes features such as automatic mileage tracking, basic bill management, and invoicing.

Integrating QuickBooks with Expensify simplifies accounting processes by automating income and expense data and updating financial reporting in real-time. In addition to tracking expenses, the integration also streamlines financial reporting, improves visibility and data reliability, and reduces errors and tedious manual data entry. This free QuickBooks integration ensures accurate and up-to-date accounting records and facilitates informed decision-making for business growth.

The app’s user interface is pretty simple, but I’ve found that this simplicity can sometimes make it confusing to use. For example, understanding the difference between a report that’s closed and a report that’s still being processed can be unclear.

It also has a higher learning curve for users new to accounting and expense tracking. Additionally, its premium plans are relatively expensive, particularly if not bundled with the Expensify Card. The price doubles if not bundled, resulting in a significant difference of $18 per user instead of $9 per user, which I think is quite an outrageous difference.

- Enables instant payments

- Allows sellers to send invoices

- Works with multiple currencies

- Two-factor authorization for security

- Integrations with accounting software, ecommerce software, and more

- Easy transaction tracking

- Custom reports for tax purposes

- Trusted by users around the world

- Transparent processing of payments

- Safe and secure platform for sending and receiving payments

- High international transfer fees

- Lack of customer support when resolving disputes

- Tendency to freeze or hold accounts without a clear reason

PayPal is a comprehensive solution that caters to businesses of all sizes, from startups to established enterprises. With access to over 295 million PayPal customers across various platforms and marketplaces, businesses can expand their reach and tap into new markets and high-value customer segments. Furthermore, PayPal provides customers with the flexibility to make purchases anywhere in the world.

In addition to its widespread popularity as a payment processing platform, many people recognize PayPal as a trusted and reliable payment option. It offers a range of services for business owners, including accepting payments on websites and in-person transactions. Security is also a top priority when it comes to transactions, and PayPal ensures that transactions are monitored in real time to prevent fraud and maintain transaction safety.

Free QuickBooks integrations like PayPal offers numerous benefits for businesses. Firstly, it allows for the creation of invoices in an instant, giving customers a convenient and secure way to pay. With the integration, customers can easily pay invoices from anywhere, at any time, and on any device, increasing the likelihood of prompt payment and boosting cashflow.

Additionally, integrating QuickBooks with PayPal saves businesses valuable accounting time, as all PayPal payments and fees are automatically recorded in QuickBooks. This eliminates the need for manual data entry, streamlining the accounting process. Overall, integrating QuickBooks with PayPal provides businesses with a seamless payment solution that is secure, efficient, and cost-effective.

One major drawback of PayPal, however, is their lack of customer support when it comes to resolving issues with sellers. This can be quite frustrating, especially for users who are struggling to resolve disputes. Users often find it more beneficial to pay directly with their credit card and communicate with their bank for better assistance.

Additionally, PayPal imposes high transaction fees, particularly when transferring funds internationally. This can be a significant disadvantage, especially if one frequently engages in cross-border transactions. I’ve found that these fees can be quite discouraging and are pushing people to turn to PayPal’s numerous other competitors instead.

Overall, while PayPal may offer convenience and security for certain transactions, its various drawbacks and shortcomings should be carefully considered before relying on the platform.

- Calculation of different pay rates

- Reporting features with interactive charts

- Free time clock software with location tracking

- Mobile app for staff monitoring and shift management

- Employee scheduling with drag-and-drop functionality

- Copy, cut, and paste functions

- Seamless sharing of information

- Ability to generate various reports

- Convenient staff leave request system

- Simple and efficient scheduling of shifts

- Mobile app has very limited functionality

- Difficult to make up for missed clock-outs

- No way to create and use scheduling templates

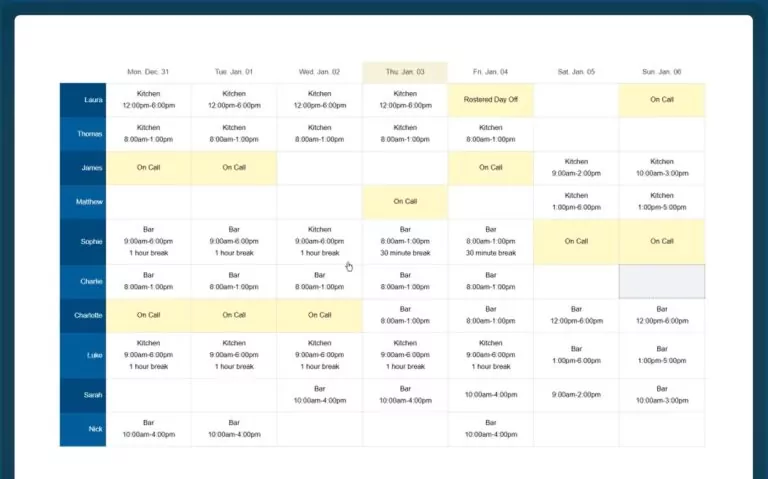

Findmyshift is a comprehensive employee scheduling app that offers a range of features to help organizations effectively manage their workforce. With time-clocking and timesheet capabilities, users can easily track and monitor the hours their employees are working. This data can then be used to generate accurate payroll calculations and cost reports, simplifying the payroll process.

Additionally, Findmyshift provides vacation management tools, allowing users to keep track of employee vacations and calculate remaining allowances. This feature helps organizations identify when employees are unavailable and make necessary adjustments to the schedule. The app also offers messaging and notification options, enabling users to communicate with employees via email, text message, or push notification. Employees can request, cancel, and swap shifts through the app, pending manager approval.

With Findmyshift’s drag-and-drop interface, managers can easily create, edit, review, and publish schedules from anywhere, ensuring that employees are assigned to shifts in a timely and organized manner.

Integrating QuickBooks with Findmyshift offers several benefits for businesses. Firstly, by integrating the two software programs, businesses can streamline their accounting and scheduling processes. QuickBooks provides powerful accounting features, allowing businesses to easily track expenses and generate custom reports. By integrating with Findmyshift, businesses can also efficiently manage employee scheduling.

Additionally, the integration between QuickBooks and Findmyshift allows businesses to improve accuracy and save time. With Findmyshift’s time tracking feature, businesses can ensure that employee time entries align with the scheduled shifts, reducing errors and minimizing payroll discrepancies. By integrating these two software programs, businesses can benefit from increased efficiency, accuracy, and time savings, ultimately leading to improved productivity and profitability.

One drawback to Findmyshift, however, is that its mobile app is quite basic and doesn’t have many features, which limits its functionality. This can be a disadvantage for managers who rely on their mobile devices for managing schedules and employee information.

Additionally, the app lacks consolidation in its reports, particularly in the hours section. This can make it difficult for managers to quickly and efficiently analyze and summarize employee hours for payroll or other reporting purposes.

- Automation of manual tasks

- Efficient performance tracking

- Task delegation for team members

- Tracking of service level agreements

- Standard operating procedure creation

- Generous free plan

- Useful automations

- Easy to navigate layout

- Keeps track of to-dos and daily processes

- Versatile project tracking and client management tool

- No resources for beginners to learn the app

- Does not give progress updates in real-time

- No advanced features and tools like performance tracking

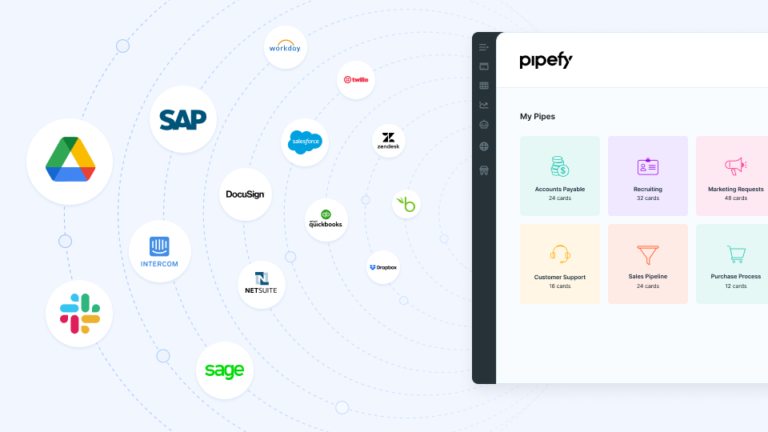

Pipefy is a highly efficient workflow management software that allows businesses to streamline various processes, such as purchasing, job opening, accounts payable, and employee onboarding. By eliminating the need for IT implementation, Pipefy empowers businesses to drive digital transformation, gain control over service request volumes, and refocus on strategic initiatives and activities.

With its ability to increase team productivity, centralize data, and optimize processes, Pipefy is an invaluable tool for various departments such as HR, Procurement, Customer Ops, IT, and more. Whether it’s achieving stack extensibility or process excellence, Pipefy helps businesses of all sizes achieve their goals and streamline their operations effectively.

Pipefy is one of my favorite free QuickBooks integrations because it can help businesses automate payment processing, create customer invoices, track expenses, and monitor client accounts. With the ability to customize billing cycles, automate reminders, and generate financial analytics, businesses can streamline their financial processes and gain valuable insights into their financial performance.

Additionally, the integration allows for accounting integration, sales tax calculation and compliance, and global payment processing, further enhancing the efficiency and accuracy of financial management. This free QuickBooks integration also allows for compliance with sales tax regulations and global payment processing, enabling businesses to expand their operations internationally.

One of the major negatives of the app Pipefy is the lack of real-time progress updates. It takes a significant amount of time to report and visualize task advancements, which can create delays and hinder effective collaboration among team members.

Another drawback of Pipefy is the absence of a centralized global approval workflow. This means that changes across the team cannot be approved all at once, making it difficult to manage approvals and keep everyone on the same page. Overall, however, there don’t seem to be grayling drawbacks to Pipefy, just a lot of small issues that can be overlooked, depending on how the service benefits your business.