Whether you are a small startup or a well-established corporation, navigating the complexities of payroll in the US is a crucial responsibility that directly impacts your employees and business performance.

This is precisely what makes payroll software a game-changer for businesses these days. Why?

An obvious primary advantage is its ability to ensure accuracy by automating complex calculations, minimizing the risk of human errors, not to mention saving significant time for HR and finance teams. Recent features of such software also ensure tax and labor law compliance which undeniably reduces the risk of penalties.

The payroll software that I have singled out here will definitely unburden the critical yet tiresome responsibility of handling employee payments and related tasks. What each app offers varies based on your requirements and expectation, but ultimately, if you’re contemplating adopting this technology, these are six top-notch apps in the US that you may want to consider.

The definitive list:

- Clock-in/out functionality on multiple platforms

- Automated calculations and advanced reporting for payroll

- Cloud-based platform offering payroll and work hours tracking

- Integration with existing payroll or accounting software using open API

- Customizable tracking of hours by activity, project, or client for billing and insights

- Free

- Easy to use

- Feature-rich software

- Excellent customer support

- Affordable with a stacked free version

- No tax filing

- Tedious process for adding explanations when altering time changes

- Employees often forget to Jibble in or out, affecting time tracking accuracy

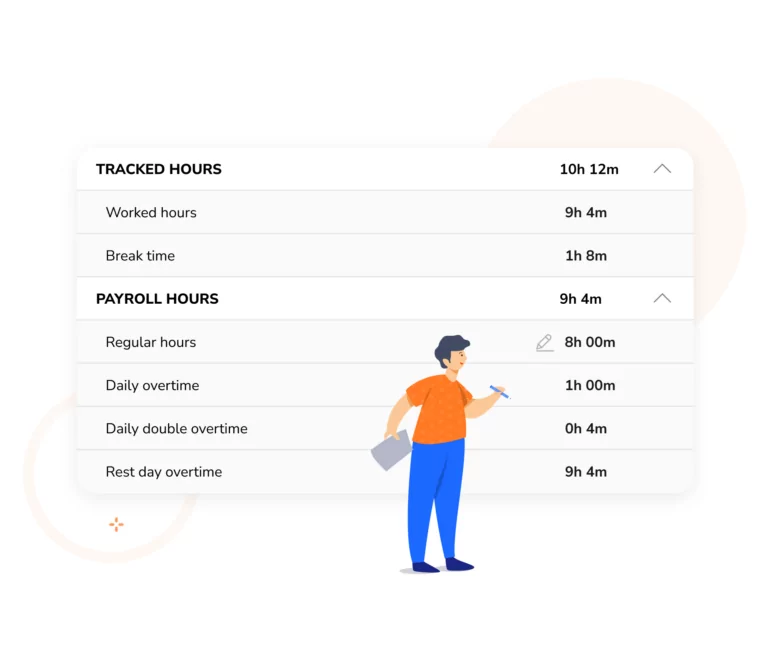

Jibble is a cloud-based platform that offers a comprehensive solution for both payroll and work hours tracking. Jibble’s payroll hours tracker comes equipped with clock-in/out functionality on multiple platforms, automated calculations, and advanced reporting. Employers have the flexibility to set up pay period time frames, ensuring accurate employee payments based on the tracked time within the designated period.

The tracking of hours can be categorized by activity, project, or client, which proves advantageous for billing purposes and gaining valuable insights into time allocation. Utilizing various filters, attendance patterns can be easily identified, enabling improved attendance management.

Tracking employee time is seamless and accessible on mobile, desktop, or tablet devices, accommodating different work settings like on-site, remote, or in-store. For larger teams, managers can approve calculated payroll hours through the approvals feature before processing payroll. Moreover, the work hours tracker allows customization of overtime payments based on specific settings such as minimum time worked or breaks.

Now, Jibble’s payroll tracker doesn’t provide extended payroll capabilities such as tax filing or direct deposit. However, it does offer swift integrations with various payroll applications for a swift process.

Payroll-ready timesheets can easily be exported in Excel or CSV format for reporting, billing, productivity management, and additional payroll calculations. Furthermore, the timesheets and reports can be easily integrated with existing payroll or accounting software using Jibble’s open API.

- Tailored solutions

- Multiple pay options

- Paychex ERTC service

- User-friendly interface

- Extensive retirement services

- Workers’ compensation insurance plans

- Integration with other Paychex Flex features

- Wage garnishments and employee self-service

- Tax services, automated tax calculations, and compliance support

- Tax reminders and IRS updates

- Compliance with federal and state laws

- All-in-one solution for payroll, HR, and reporting

- Visually appealing interface with useful information

- Smooth onboarding process with helpful support team

- Consolidated view of paychecks, deductions, tax documents, and employment details

- Issues with benefits access and enrollment

- Siloed system requiring repetitive data entry

- Missed staff payments and poor support resolution

- Login issues affecting timely clock-in and clock-out

- Unprofessional behavior and poor customer service

- Lack of detailed invoices and frequent rate increases

- Tedious setup process for basic time and labor access

- Errors in legal processes and malfunctioning timeclocks

- Numerous employee complaints and limited admin resources

- No free trial offered by Paychex and fees for any additional and custom services

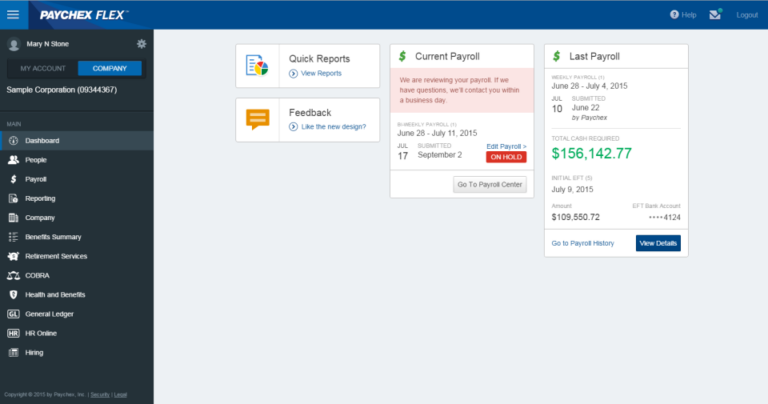

Paychex Flex, an HR, Payroll, and Benefits software, offers a user-friendly interface and automation for tax calculations, wage garnishments, and employee self-service, streamlining payroll processing for businesses. It provides tailored solutions for diverse business needs with comparison options and simplifies tax calculation, payments and filing with compliance support and 24/7 customer support. The platform offers Paychex ERTC Service for tax credit identification and Paychex Pre-Check for paycheck review. Multiple pay options are also available, including direct deposit and the integration with other Paychex Flex features such as time and attendance and retirement plans creates an all-in-one platform for comprehensive business management.

The app’s general ledger service also synchronizes payroll with accounting software. Employees can gain controlled access to payroll information, including check stubs and W-2s and extensive retirement services are offered along with access to workers’ compensation insurance plans.

I must say, Paychex exudes a remarkable aesthetic appeal with its well-designed layout and seamless user interface that makes navigation a breeze. However, several significant shortcomings of the software also can’t be ignored. Customer service has often received complaints for being subpar, with slow response times and unprofessional behavior which is certainly frustrating. Moreover, there are multiple complaints from employees about limited admin resources, login issues affecting clock-ins and clock-outs, and a siloed system requiring repetitive data entry.

- Reporting and tax form distribution

- Automated payroll and tax filing services

- Comprehensive payroll and HCM platform

- Employee self-service portals and benefits administration

- Access to Wisely by ADP® pay card balances and transactions

- IRS inquiries and state unemployment insurance management

- Direct deposit and mobile payroll integration with time and attendance tracking

- Intuitive, easy-to-use and secure

- Accessible from multiple devices

- Onboarding assistance included in packages

- Free and paid add-ons and apps from third-party providers

- Seamless integration of payroll software with HR and business management functions

- Issues with the user interface and mobile app

- No option for early pay like other services offer

- Absence of free trials or money-back guarantee

- No retained customer information at the corporation

- Customer service leaves a lot of room for improvement

- Lack of transparent pricing for payroll software packages

- Expensive Essential plan, not suitable for very small businesses

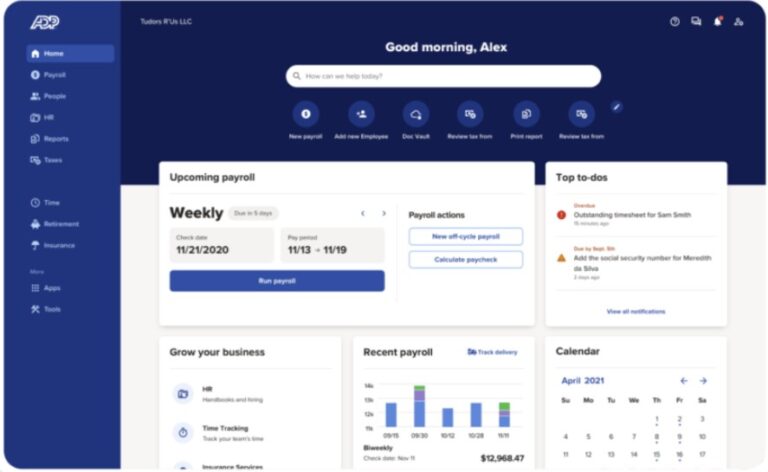

ADP Mobile Solutions, based in New Jersey, is a comprehensive payroll and human capital management (HCM) platform that offers seamless integration of direct deposit and mobile payroll with time and attendance tracking. It enables businesses to efficiently manage their payroll taxes by automating deductions from employee wages and ensuring compliance with the latest tax regulations. Employees can conveniently access their payroll information, benefits, pay statements, and manage time off through the mobile app. The platform also includes employee self-service portals, benefits administration, and customizable interfaces.

Additionally, the software handles IRS inquiries, manages state unemployment insurance (SUI), and automates payroll processing with autopilot functionality. It further streamlines reporting tasks and automates the creation and distribution of Forms W-2 and 1099. Users can also view Wisely by ADP® pay card balances and transactions conveniently.

Despite all that it has to offer, those intrigued and interested in ADP payroll would find it extremely frustrating to obtain clear pricing and understand the total cost of the software due to the complex quotation process involving multiple pages and disclaimers. Additionally, the Essential plan’s base fee is suggested to be at $79 per month, and users who managed to get a quotation mention an additional $4 per employee, which is considered quite steep. The customer service provided also may not fully meet users’ expectations considering all the software offerings.

- Tax filings and direct deposits

- State tax registration resources

- Automated payroll calculations

- Contractor payment in over 120 countries

- Gusto wallet and debit card for employees

- Transparent pricing with unlimited payrolls

- Compliance management (I-9s, W-2s, contractor 1099s)

- Integrated platform with health insurance, 401(k), workers’ comp, time tracking, PTO, and more

- Quick and easy direct deposit payment system

- Multiple direct deposit options to choose from

- Scalable payroll options for growing businesses

- User-friendly website with high intuitiveness (90%)

- Seamless integration of time tracking with full-service payroll

- Delayed loading of timesheets

- Manual time off for part-time employees

- No free trial or money-back guarantee

- Limitation in processing severance payrolls

- Navigation requires too many clicks and lack of intuitive next steps

- Generic responses to support inquiries and decline in email and online service

- Complicated process and additional costs for switching employees to W2 status

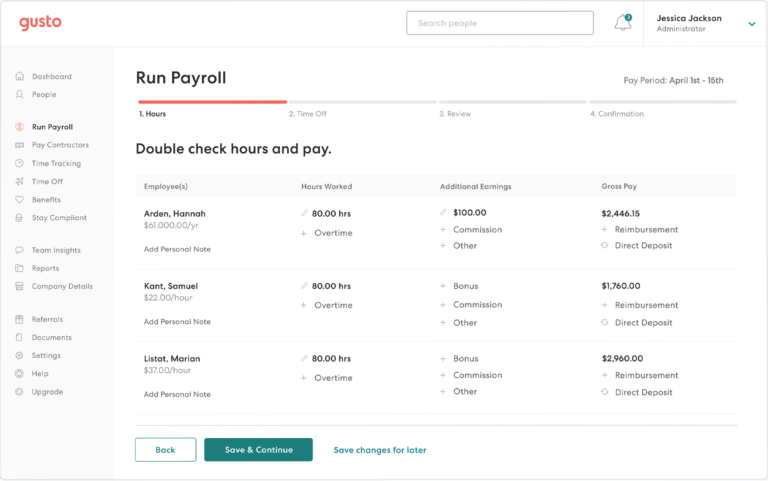

Gusto, formerly known as ZenPayroll, is a comprehensive payroll software based in California. It automates payroll calculations, tax filings, and direct deposits, and offers features like employee benefits and time tracking for streamlined HR management.

Gusto calculates and files taxes with government agencies without additional charges and provides resources for state tax registration for employees while monitoring tax law changes and managing compliance tasks like storing and organizing I-9s, W-2s, and contractor 1099s online. It also syncs various features seamlessly with payroll, including health insurance, 401(k), workers’ comp, and time tracking, making it a convenient all-in-one solution.

Gusto also facilitates contractor payments in over 120 countries and allows employees to access their funds through Gusto Wallet and the Gusto debit card for efficient financial management. However, while it offers expert support and transparent pricing, downsides of the platform include higher pricing compared to other providers and limited customer support. Additionally, although a free demo is offered, there is no free trial option, and cancellations may impact ongoing payroll and tax filings depending on timing.

- Same-day direct deposit

- Benefits administration for all tiers

- 24/7 expert support with callback assistance

- Workers’ comp coverage options with AP Intego

- Tax penalty protection up to $25,000 for users

- Access to retirement plans via Guideline

- Auto payroll taxes calculation, filing, and payment of payroll taxes and forms

- Affordable medical, dental, and vision insurance packages through SimplyInsured

- Intuitive user experience

- Enhanced employee profiles

- Accurate payroll processing

- Flexible and comprehensive setup

- Customizable and informative reports

- Automatic filing of federal and state taxes

- Added tax penalty protection with Elite Plan

- Seamless integration with QuickBooks Online

- Expensive pricing

- No automation for local taxes

- Occasional server connection issues

- Time tracking limited to top-tier plans

- Room for improvement in post-payroll wrap-up

- Additional filing fees for Core and Premium plans

- Limited integrations without QuickBooks Online

- Frustrating updates and importing features, including lost files

- Poor customer service experience and limited support for tax questions

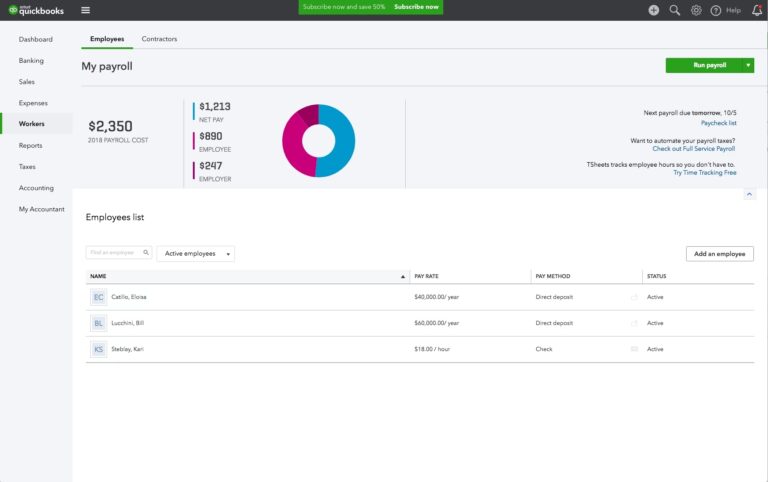

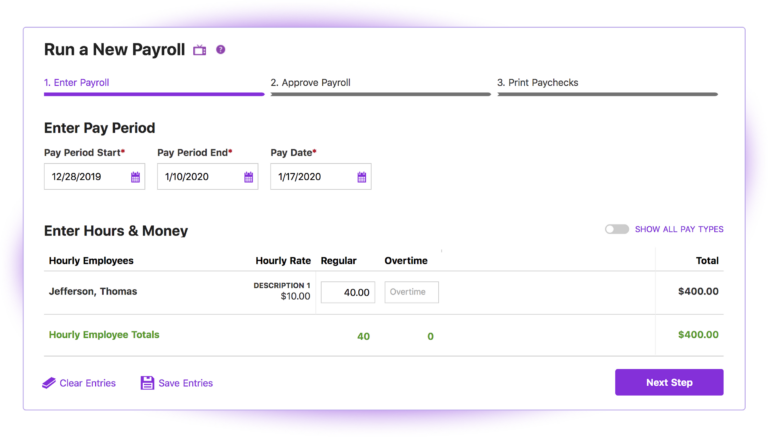

QuickBooks Payroll is a cloud-based payroll solution offered by the famous accounting software Intuit. Integrated into the renowned QuickBooks accounting software headquartered in California, it simplifies payroll management. Tailored for small to midsize businesses, it provides same-day direct deposit and auto taxes and forms to calculate, file, and pay payroll taxes seamlessly. The software also provides customizable payroll reports covering multiple worksites, deductions, tax liability, and time activities along with time tracking, approving timesheets, and creating invoices on the go as well as easy creation and e-filing of 1099-MISC and 1099-NEC forms.

A standout feature of QuickBooks Payroll is the tax penalty protection that offers up to $25,000 coverage to businesses in case of penalties for added peace of mind. Further, the software boasts 24/7 expert support and through collaboration with Mineral, Inc., offers additional assistance and HR resources. Workers’ comp coverage options are offered with AP Intego, medical, dental, and vision insurance packages through SimplyInsured, and retirement plans with Guideline enhance employee benefits.

That being said, the software does encounter occasional glitches and customer support is frequently called out for being non-responsive. And while QuickBooks payroll efficiently handles federal, state, and local taxes, automation is available only for state and federal taxes. Also, the least expensive version of the software, at $45 per month plus $5 per employee per month, can be a significant expense for small businesses.

- USA-based support available at no charge

- Seamless and cost-free onboarding and setup process

- Swift and complimentary 2-day direct deposit service

- No obligation for long-term contracts; the freedom to cancel at any time

- Unlimited payrolls covered under a single monthly price, with no hidden fees

- Handles all tax filings

- User-friendly interface

- Great customer service department

- Suitable for businesses with tighter budgets

- Easy navigation for payroll and payroll reports

- Provides quick availability of W-2 at year-end

- Allows multiple payrolls per month for the same fee

- Primarily caters to businesses based in the United States

- Outdated design

- Set up issues and lack of finalization

- Limited customization compared to other software

- No benefits administration or free HR services

- Additional cost for each additional employee

- Not ideal for larger companies with many employees

- Lack of integration with apps, requiring manual entry

- No one-day direct deposit option for contractors

- Not suitable for companies outside the United States or with employees abroad

- No automatic bundling of payroll, accounting, and HR features

Patriot Payroll is a comprehensive and affordable human resource (HR) and payroll management solution, from Patriot Software. This software is particularly good for simplifying payroll processing for small businesses ranging from 1 to 500 employees and serves a diverse range of industries, including distribution, retail, engineering, maintenance/field service, and others. It accurately calculates wages, taxes, and deductions, streamlining payment procedures. The software offers direct deposit options and ensures compliance with federal, state, and local tax regulations.

Employees can access their pay stubs and W-2s through the employee self-service portal. Patriot Payroll’s basic and full-service options include a suite of built-in reports, though not customizable. The software also provides time and attendance tracking features to monitor employee work hours. Businesses can generate various payroll reports for informed decision-making and have access to free USA-based support.

However, I must say that for Patriot’s as an HR solution, the absence of an HR add-on is quite a miss as it forces users to make a separate purchase for that functionality. Patriot also does not handle the administration of employee benefits with external providers, such as health insurance companies or 401(k) providers.

Furthermore, there are additional fees associated with Patriot’s basic payroll software. Users are required to pay a fee for e-filing 1099 forms and small businesses filing taxes in multiple states incur an extra cost of $12 per month, per state, for additional state tax filings. These fees can become a concern for businesses with specific needs or multiple contractors.

If you have found this list helpful, yet, still feel unconfident about managing your payroll, here is a step-by-step guide to running US payroll. Alternatively, if you already have a system in place, here are 10 tips to streamline your payroll in the US.