Employers are using a sneaky method of avoiding paying their staff overtime payments. The practice is widespread, on the increase, and top employers including Walmart, Avis and JPMorgan have ended up in court and losing or settling for millions of dollars over this practice.

In this article I will go through:

- How US Employers are avoiding OT Payments

- Evidence of Overtime Avoidance being Widespread

- Top 25 US Firms Supposedly Avoiding Overtime

- Public Lawsuits Involving Overtime Payment Avoidance

- Final Thoughts

How US Employers are avoiding OT Payments

Ok, so you’re probably aware, or could have at least guessed, that businesses have been avoiding paying overtime payments through misclassifying employees as independent contractors, failing to record their overtime hours, or pressuring employees to work “off the clock”. But, as I discuss in this article, many employers are being a little more sneaky and somewhat sophisticated in avoiding payments.

According to a 2023 research publication Too Many Managers: The Strategic Use of Titles to Avoid Overtime Payment, by Lauren Cohen of Harvard Business School, and N Bugra Ozel and Umit Gurun of the University of Texas at Dallas, there is “widespread evidence of firms appearing to avoid paying overtime wages by exploiting a federal law that allows them to do so for employees termed as “managers” and paid a salary above a pre-defined dollar threshold.”

Businesses involved in this practice, a practice which is on the increase, save around 13.5% in overtime payments for each misclassified “manager”, according to the study which analyzed the Burning Glass Technologies dataset on job postings along with other data.

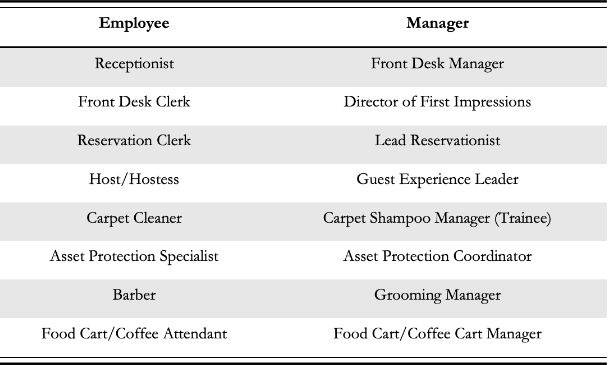

The article goes on and describes salaried position listings with managerial titles have an almost 5x increase around the federal regulatory threshold, including the listing of managerial positions such as “Front Desk Manager”, i.e. a receptionist, whose jobs are otherwise equivalent to non-managerial employees.

In the US, employers are generally required to pay their employees overtime wages for any hours worked over 40 in a workweek, at a rate of 1.5x their regular hourly rate. This is as per the Fair Labor Standards Act (FLSA) which is designed to protect workers from being exploited by employers who might otherwise require them to work long hours without appropriate compensation, but some employees are exempt from this rule.

On a side note, if you want to make calculating employee overtime easier you might find Jibble’s work hours calculator or employee overtime tracker handy.

Anyway, I digress, so the FLSA defines an exempt employee as one that passes these three tests:

- The salary basis test – which requires the employee to receive a pre-determined and fixed salary on a weekly or less frequent basis, independent of the number of hours or quantity of work performed (i.e., must be salaried as opposed to hourly)..

- The salary test – which requires the employee’s salary to meet the exemption threshold, which was $455 per week during the sample period of the study.

- The duties test – which requires the employee’s work to primarily involve executive, administrative, or professional duties as defined by the regulations.

What this means is that for firms to avoid paying overtime to an employee, the employee’s pay must be above the regulatory threshold, the position must be salaried and he or she must be essentially ‘managerial’.

Evidence of Overtime Avoidance being Widespread

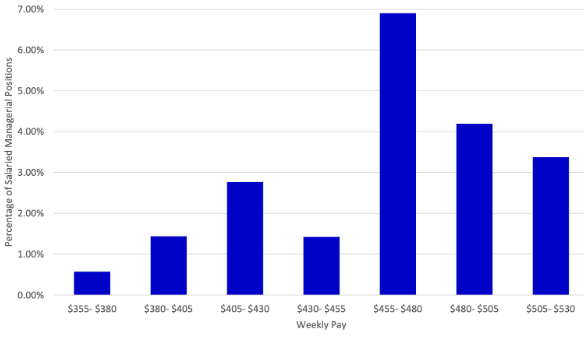

One of the key bits of evidence that this avoidance of overtime is widespread is the graph below.

We see an almost 5 fold increase in the usage of managerial titles for salaried employees just above the $455/week pay threshold set in the FSLA, which allows the firms to avoid paying overtime compensation to these workers. When you add that to the questionable managerial titles such as Front Desk Manager, there isn’t any other explanation which makes sense of this data, well not to me nor the authors of the study.

The study does further analysis of the data, but I didn’t feel that it shed much more light, as this graph alone is compelling enough.

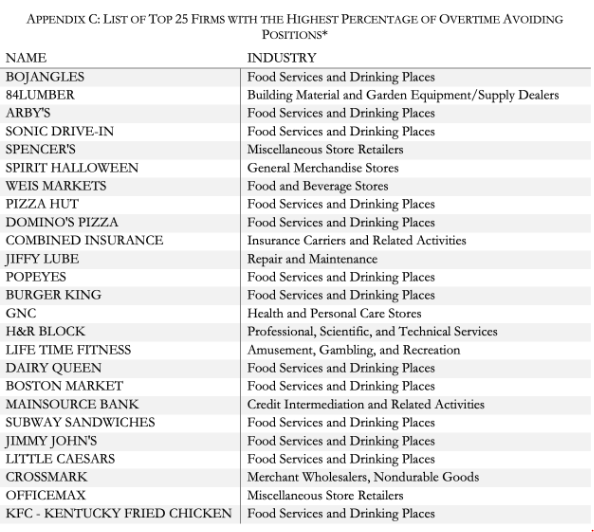

Top 25 US Firms Supposedly Avoiding Overtime

The authors of the research piece didn’t hold back, and they give a list of the top 25 firms with the highest percentage of overtime avoiding positions – it only included firms with a minimum of 100 job postings with a weekly pay of $405 to $505 between 2010 and 2018 and included positions in both firm-owned and franchise locations.

Hmmm, given it’s all so visible through collating job posting data, that’s rather concerning for larger enterprises that carry out this practice.

Public Lawsuits Involving Overtime Payment Avoidance

Unsurprisingly, there have been several high profile lawsuits related to unpaid overtime. Here are a few to bring to your attention…

1. Panera Franchisee Paid $4.62M to Settle OT Suit

The country’s largest Panera Bread franchisee, Covelli Enterprises, was required to pay $4.62 million to settle a class action case by 900 assistant managers involving overtime pay. The lawsuit dated back to January 2018 when a group of Panera assistant managers in Ohio filed suit against the operator claiming that they were being forced to work without overtime pay after being wrongly classified as exempt from overtime protections.

2. JPMorgan Agreed to $16.7M in OT Lawsuit

JPMorgan Chase & Co agreed to pay $16.7 million in 2017 to resolve a lawsuit accusing it of violating federal law by misclassifying assistant branch managers at its banks across the country and failing to pay them overtime. The employees claimed that even though they had no management duties, Chase classified them as exempt from overtime in violation of the FLSA and New York labor laws, Connecticut labor laws, and Illinois labor laws.

3. $7.8M Avis Shift Managers OT Deal

In 2016, 249 shift managers who sued Avis Budget Car Rental LLC over unpaid overtime wages scored final approval of a $7.8 million settlement to end two long-running FLSA collective actions. They alleged they were wrongfully classified as exempt employees under the FLSA.

4. Office Max $3.5M OT Pay Settlement

In 2015, a settlement was reached between OfficeMax Inc. and a group of over 330 current and former assistant managers who filed a class action overtime lawsuit against their employer for violating the FLSA. The settlement agreement is worth over $3.5 million and will be distributed among the members of the class who opted into the lawsuit based on the number of weeks they worked during the time period covered by the settlement. The attorneys representing the plaintiffs will be seeking up to one-third of the settlement fund, or approximately $1.6 million. The managers alleged that OfficeMax did not pay them overtime wages despite working more than 40 hours a week and performing non-exempt duties similar to those performed by non-exempt employees, including customer service, stocking shelves, operating the cash register, unloading trucks, selling merchandise, setting up displays, counting inventory, and cleaning the store.

5. Lowe’s Settles for $9.5M in OT Suit

Nationwide retailer Lowe’s agreed to pay $9.5 million in 2014 to end a two-year class action lawsuit alleging the company “misclassified” up to 1,750 of its human resource managers in violation of the FLSA. The original complaint claimed that Lowe’s violated FLSA overtime wage provisions by hiring employees as “human resources managers” but giving them the clerical duties of “low-level” human resources workers without the eligibility for overtime pay. Though her job title was that of a manager, Lytle says she lacked the authority to fire or hire, promote, discipline, or give raises to workers. Additionally, Lytle says that she and other similarly-titled employees were required to work 55 hours of work per week, but received no overtime compensation as a result. Lytle also alleged Lowe’s failed to track employee time, if not all of the company’s human resource managers, and that the act of paying those employees on a salary basis did not meet the requirements of an FLSA-exempt status.

6. Walmart Agreed $4.8 Million in OT

The Department of Labor announced that Walmart had agreed to pay $4.83 million in 2012 in back wages and damages to employees it had illegally denied overtime, following an agency investigation. More than 4,000 workers, all managers or asset protection coordinators, were to receive money from the settlement.

7. Staples Settled OT Lawsuits for $42M

In 2010, Staples agreed to pay $42 million to settle several class-action lawsuits related to overtime pay violations. The retailer was accused of misclassifying assistant store managers as exempt from overtime compensation.

Final Thoughts

There is clearly widespread and systematic exploitation of the provision of the FLSA that allows employees to be exempt from having to pay overtime wages if an employee is essentially a manager and paid a salary above the threshold. While we don’t show it here, despite the lawsuits this practice is on the increase.

The thing is that, thanks to the internet and social media, employees have become more aware of their rights, and that’s a trend that’s only going to increase, and you can bet your bottom dollar they will be more willing to go to court to get those rights. HR departments, managers and business owners need to be aware and careful. Staying informed and proactive in addressing these issues is crucial for maintaining a fair and legally sound work environment.